Can trade create activism among Asian economies with challenging characteristics?

The fortunes of Asia's developing countries can swing wildly. Frontier economies like Myanmar and Mongolia were deserted by investors just a decade ago. Today, both are booming--one from a market opening gold rush and the other from a mineral mining frenzy. Many economies in Asia and the Pacific that display challenging characteristics have nevertheless experienced stable growth in recent years. This, coupled with an increasingly accommodating trade environment, presents these states with an unprecedented opportunity to influence the direction taken by regional trade institutions. So far they have been silent partners in integration, might this change?

Membership without Participation

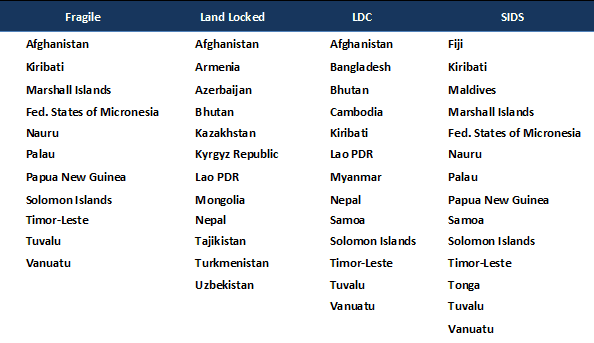

Of ADB’s 44 developing member countries, about 65% (see Figure 1) fall into the categories of fragile, landlocked, least developed countries (LDCs), or small island developing states (SIDS). While LDCs benefit from an international regime that recognizes their need for special and differential treatment, there is no consistent policy towards other states in this group. ADB has only recently introduced a handbook on fragile states for example.

Figure 1. ADB Developing Member States with Challenging Characteristics

Sources: Fragile states--ADB (2012) Working Differently in Fragile and Conflict Affected Situations: The ADB Experience.

Landlocked, LDCs and SIDS--UN-OHRLLS.

Despite their weaknesses, these states are plugged into regional and global institutions of trade--16 states in this group are also members of the WTO and they have signed a total of 107 Free Trade Agreements (see Trade Institutions and Asian Economies with Challenging Characteristics).

Activism is unusual, but it is also not unheard of--Vanuatu famously suspended its WTO accession proceedings in 2001 after charging that it had limited influence over the process. And Bangladesh is one of the few Asian LDCs that has participated in a WTO dispute settlement case. Many countries struggle to participate because of a lack of skilled negotiators. And those with skills are either overburdened with work or easily lured away by international institutions.

Opportunities for Activism

Activism by these states has traditionally been minimal as a result of a combination of weak domestic capacity and an unsupportive international institutional environment. While both change only slowly, two recent developments have opened political space that can enable Asian economies with challenging characteristics to participate more actively.

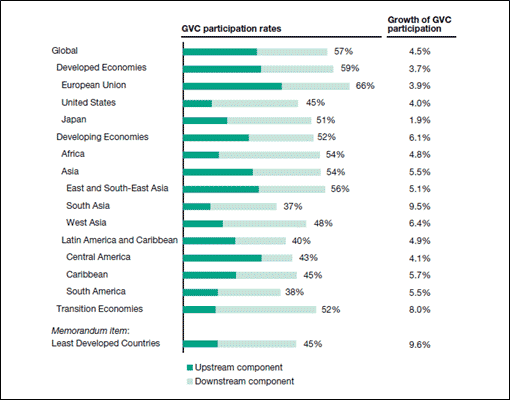

The first is the expansion of Factory Asia. Despite a difficult international economy, Asia is expected to retain its growth momentum in coming years. Much of this resilience is due to the establishment of regional production networks. As Asia’s largest states continue to move up the value chain, space has opened for lower-income countries to pick up the slack in low-skilled manufacturing. Some have suggested the shifting geography of Global Value Chains (GVCs) may pull in even marginalized states. Encouragingly, Figure 2 shows that Asia’s growth rates of GVC participation are on the high end of all developing countries.

Figure 2. GVC participation (2010) and GVC growth rates (2005-2010)

Source: UNCTAD (2013) Global Value Chains and Development Figure 9.

Their source: UNCTAD-Eora GVC Database.

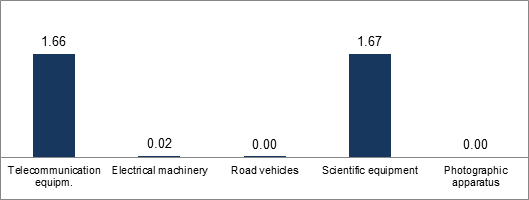

While participation by Asian economies with challenging characteristics in GVCs remains limited, we have seen movement over the past few years. Figure 3 shows Myanmar’s production of goods that are currently traded within regional production networks. While volumes remain very small, they are positive and growing. By gaining a toe-hold Asian economies with challenging characteristics can use their experience to better understand and influence ongoing trade negotiations such as the recently announced Regional Comprehensive Economic Partnership Agreement (RCEP).

Figure 3. Myanmar's Exports of Value-Chain Relevant Goods (Millions $, 2010)

Source: UN COMTRADE.

A second development that has opened up space for the participation of the states in Figure 1 is the changing role of the private sector in the development policy paradigm. This is best evidenced by a global move away from viewing Aid for Trade (AfT) as a stand-alone source of development assistance. The focus has now shifted to the effectiveness of AfT in establishing an enabling environment for the private sector. This fits with the new reality of global trade where manufacturing is characterized by trade between countries that specialize in particular segments of a production chain.

By bringing in the private sector as a key development partner, even economies that lack adequate human resources gain access to additional skilled capacity. This can ease critical human resource bottlenecks in trade negotiations, targeted assistance and development planning.

Going forward

It remains unclear how Asian economies with challenging characteristics will respond to the critical juncture presented by these two trends in the trade environment. Political space is a necessary but insufficient condition for activism among states that have traditionally been inactive and additional support from donors and neighbors is needed. There has been some movement on the margins as LDCs such as Cambodia have broken into regional production networks and the People’s Republic of China has opened links with Laos. If the small developments mentioned here can be properly harnessed, they will provide an important catalyst that can make regional integration a truly regional project.