Overcoming informal trade barriers in Central Asia

The need for more effective trade facilitation was on the front burner for the recently concluded World Trade Organization (WTO) Ministerial Meeting in Bali. For countries in Central Asia this issue is particularly critical. Countries in the region have made important strides in formalizing trade relationships. But a survey of the private sector in Kazakhstan and Uzbekistan reveals that informal barriers continue to limit further intensification of trade relations. We describe the results of our surveys below and offer some recommendations for how the private sector may overcome this hurdle.

Regional integration is active, but can be strengthened

Currently intensive trade integration is taking place in Central Asia. Kyrgyzstan and Tajikistan are members of the WTO, with Kazakhstan and Uzbekistan also seeking membership. Kazakhstan is part of a Customs Union with Russia and Belarus, which Kyrgyzstan is poised to join. A look at the WTO Trade Agreements Gateway reveals that all countries in the region have notified a number of different existing agreements, and the Asia Regional Integration Center Database suggests this trend will continue via agreements that have been announced publically (Table 1).

| # Notified FTAs | # pipeline | |

| Kazakhstan | 9 | 5 |

| Kyrgyzstan | 8 | 1 |

| Tajikistan | 4 | 2 |

| Uzbekistan | 4 | 1 |

|

Note: Pipeline indicates that either negotiations have been launched or are under study. Source: WTO Trade Agreements Gateway and Asia Regional Integration Center. |

||

Despite the active regional integration agenda, private companies in Kazakhstan and Uzbekistan have low levels of internationalization. In part this is because domestic markets are still young and not yet satiated. Where firms do engage in export, they tend to target the traditional export partner of Russia rather than their neighbours. Our survey suggests that opportunities for cross-border trade exist, but are not being taken advantage of.

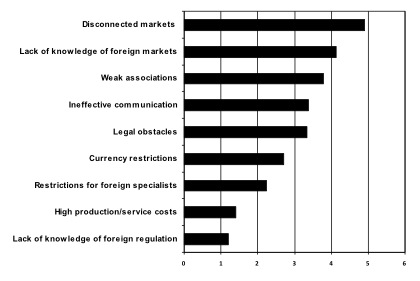

In order to understand the barriers to growth facing the private sector in Central Asia, we conducted a survey from 2010–2012 of 108 firms in Kazakhstan and Uzbekistan. The results underscored the importance of informal barriers in limiting exports from firms in manufacturing, transport and agriculture. The informal barriers most frequently indicated by respondents are listed below (see Figure 1).

|

|

Notes: The above represent the aggregate distribution of answers; average mean on a scale of 0 to 6, where 0 is no influence at all and 6 having the biggest influence. Source: Authors’ compilation. |

The problems of disconnected markets and lack of knowledge of foreign markets are obstacles related to the problem of information asymmetries. Where companies lack information about the demand-supply situation in neighbouring countries, and thus do not have incentives to enter.

The problems of weak industry associations and ineffective communication among companies are also important, as they point to problems of disconnected markets and lack of knowledge of foreign markets. The lack of effective associations, which brings companies together domestically and help to establish contacts with associations from the same industry in other countries, is a serious impediment for expansion strategies of domestic companies. These associations can collect necessary information about foreign markets and their supply-demand situation, and then spread this information among their constituents. This would allow firms to enter foreign markets having relatively complete information. Currently, companies in both countries resort to the use of bilateral mechanisms of communication which is inefficient, owning to problems in effective communication.

Conclusions and Policy recommendations

Reliance on government support is important for companies in Kazakhstan and Uzbekistan. Among the three highlighted industries, cross-border agricultural trade is unlikely to increase due to restrictions imposed by their governments. Manufacturing has the highest potential, as the governments of both countries encourage export-related manufacturing as a source of foreign currency and sustainability of their respective economies. As companies tend to agree on the role of the government in expanding to other markets, it is likely that manufacturing will catch up and take up the required niche in neighbouring countries in the near future. This in turn, should be positively reflected in the transport sector as an essential means of delivering manufactured goods.

Both private companies and the governments of Kazakhstan and Uzbekistan should unite in their efforts towards eliminating the problem of lack of information about foreign markets. Establishing strong industry associations would partially solve this issue. The creation of effective associations in the agricultural, manufacturing and transportation sectors would serve the purpose of filling in the information gaps about foreign markets, thus also contributing to a solution to the problem of disconnected markets. In turn, this would enormously contribute to facilitation of cross-border trade and intensification of regional integration.

* Roman Vakulchuk, Senior Research Fellow, Norwegian Institute of International Affairs (NUPI) , Farrukh Irnazarov, Country Director, Central Asian Development Institute (CADI)