Emerging East Asia’s Economic Outlook for 2013

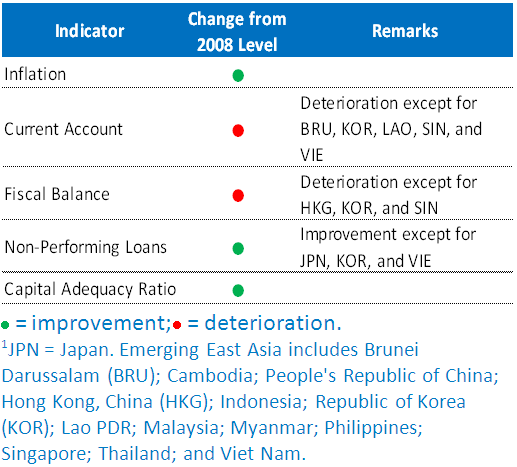

Table 2: Vulnerability in Emerging East Asia and Japan1

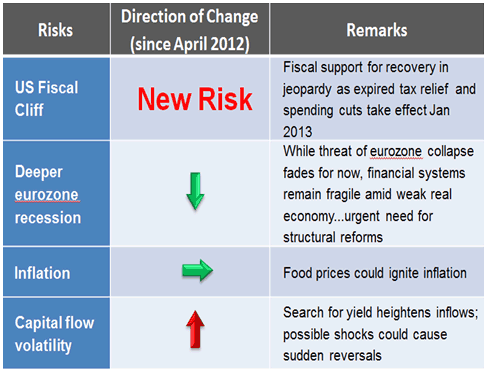

Table 3: Risks in Emerging East Asia

Despite some improvements, the global economy will remain weak in 2013. Despite the steady growth of employment and rebound in consumer confidence and house prices, the US economic recovery will remain mild. In Europe, economic stagnation and financial volatility are continuing with high unemployment rate and urgent need of structural reforms. The growth of global trade volumes has remained sluggish. And commodity prices could also surprise on the upside and disturb the muted inflationary pressures in advanced economies.

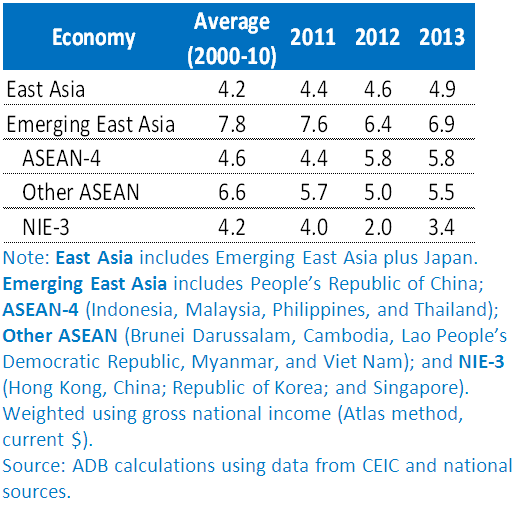

In step with shaky global conditions, growth in emerging East Asia moderated in 2012 but should increase slightly next year as the PRC economy improves (Table 1). GDP growth in PRC has already picked up from the very bottom at 2.0% (P) in Q2 to 2.2% in Q3, and leading indicators suggest growth could start to pick up as electricity and cement output has been rising since August and retail sales are up in September. All these, amid government moves to loosen monetary policy and resume fiscal stimulus.

Output growth in Japan and NIES slowed further this year but is likely to recover next year aided by timely policy response. Japan’s economic recovery hit a snag in the third quarter due to the strong yen and weaker external demand, although monetary easing and additional stimulus could provide some respite. Leading indicators in the highly-open NIE-3 economies also point to continued moderation as year-end approaches although a significant rebound is expected next year with global economic conditions improving somewhat.

Growth in ASEAN remains robust and will continue to improve further next year. Strong domestic demand from middle-income ASEAN and economic momentum of small ASEAN economies are keeping the region’s robust growth afloat. Indonesia, Malaysia, the Philippines and Thailand have recorded above trend growth on the back of strong consumer demand and government spending. On the other hand, the small ASEAN economies particular Myanmar and Lao PDR are benefitting from market reform, Cambodia from strong performance of mining, utilities and tourism and Viet Nam from policy easing.

The region’s economies continue to strengthen their resilience to banking, financial, and external vulnerabilities. Banking system in the region continue to post high profits with non-performing loans declining for most economies, except Viet Nam (Table 2). Fiscal position also remains healthy with sovereign debt of most economies below 60% of GDP. The balance of payment positions of most countries are still in surplus, although the region’s current account surpluses are narrowing.

Four downside risks could damage the outlook: (i) a worsening eurozone debt crisis; (ii) the US fiscal cliff; (iii) destabilizing capital flows; and (iv) rising global food prices (Table 3). Foremost is the fragile state of the financial and banking system in Europe. While prospects of a euroze breakout has receeded, the debt crisis has not been resolved and problematic countries are still struggling to pay their debt and design and implement necessary reforms including austerity. Going forward any payment default and concerns on feasibility of reforms could still trigger a banking crisis and curtail bank lending. In the US, the looming fiscal cliff could still derail the fragile recovery and push the economy into recession. Estimates suggest that if a divided congress fails to resove the fiscal issues and severely cut US deficit down to 4% in 2013, the US economic growth could fall by 2.5 percentage points. Another challenge that the region is facing is volatile capital flows which could create large exchange rate adjustments and adversely affect exports. Commodity prices could also put upward pressure on inflation in the region.

There are a number of key policy imperatives for the region to mitigate these risks.

- Firstly, the region must continue to address short-term problems—through counter cyclical measures—while looking into the future and continuing to implement medium-term structural reforms.

- Continuously promoting regional cooperation and integration is equally important to rebalance demand towards domestic and regional.

- We need to manage capital flows to ensure that financial resources are used productively. This would require financial sector development and macroprudential policy to ensure long-term financial stability.

- We need to ensure growth is inclusive, equitable and environmentally sustainable. This can be attained by developing and broadening human capital, creating more productive and green jobs, building inclusive financial systems, addressing infrastructure constraints to connect landlocked and isolated economies, investing in environmentally sustainable development, and providing effective safety nets.