Modern services exports from emerging Asian countries — Perspectives and opportunities

Over the past two decades, technological developments, liberalization of services trade and growing shares of services in most economies have resulted in the increasing globalization of services. In terms of world GDP, the share of services has increased from 59% in 1985 to 71% in 2011, underscoring the tremendous scope for trade in services. Also, the unprecedented advancements in information and communications technologies (ICTs) have made it possible to provide many services across borders without physical movement of persons. However, the extent to which these opportunities have benefited Asia’s sub-regions differs greatly.

ICTs have revolutionized services trade possibilities

Modern services, including telecommunications, computer and information, banking, insurance, and business services have revolutionized trade in services. Given these developments, modern services exports are growing more than traditional services exports such as transport and travel services, and reached $2.3 trillion in 2011, from $0.3 trillion in 1990. In 2011, the share of modern services was 54% of the total services trade, an increase from 35% in 1990. Overall, the modern services trade is growing even faster than the goods trade. Since 1990, modern services trade has increased 7.7-fold compared to a 5.1-fold increase in goods trade.

| Exports of Modern Services |

|---|

|

|

Note: We derive the category of Modern Services from the Extended Balance of Payments Services (EBOPS) classification of Commercial Services from which we exclude transport and travel services; Business and Professional Services are equivalent to ‘Other Business Services’ in the EBOPS classification |

Asia has emerged a key player

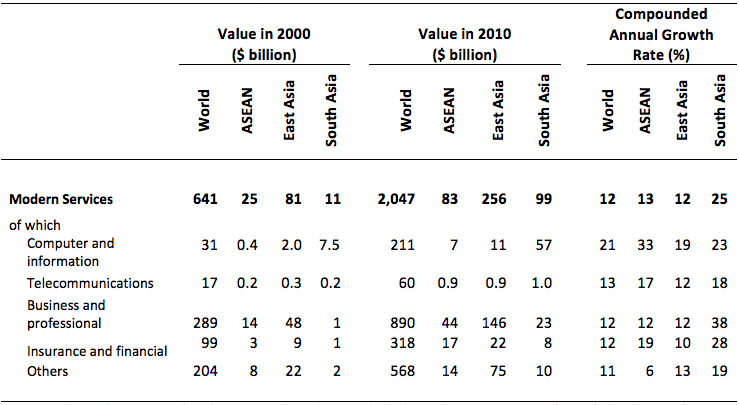

In this growing market of modern services, the regions of South Asia, East Asia and the Association of South East Asian Nations (ASEAN) are increasingly active. However, there are differences in the export growth among countries and across service sectors. From 2000 to 2010, the overall growth rate in the modern services exports of South Asia was almost double the growth rate of these exports from East Asia, ASEAN and the rest of the world (see Table). Export growth of South Asia in almost all the major sub-categories of modern services has outperformed other regions mainly fueled by India’s information technology (IT) and IT-enabled services growth.

Computer related, telecommunications, and business and professional services cover more than 67% of modern services exports from Asian countries (see Table). These are the fastest growing segments of services trade for the emerging Asian economies engaged in outsourcing activities.

| Share in the World Services Exports (%) |

|---|

|

| Note: These are regional shares in the world exports of respective service categories. Source: UN Services Trade Database and World Development Indicators. |

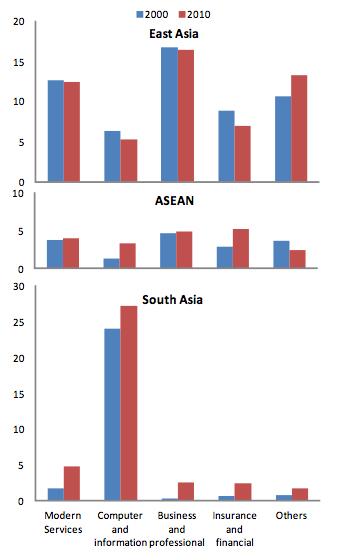

Emerging Asian countries, excluding India, have not experienced a significant change in their share of global modern services exports, showing that the benefits of the increase in modern services trade is limited to a few emerging countries. In terms of world shares of modern services exports, East Asia and ASEAN regions did not show significant increases in their total share between 2000 and 2010 (see Figure).South Asia performed considerably better during this period, increasing its global share of modern services exports from 1.7% in 2000 to 4.9% in 2010, mainly due to India’s exports of computer and business services. ASEAN countries have also improved their global shares in computer, business and insurance services exports. The Philippines and Singapore, in particular, are major exporters of business and computer services, while the rest of ASEAN has yet to explore this potential.

Services Trade and the Future

The globalization of IT-enabled modern services is similar to the reorganization of production processes seen in manufactured goods, where production locations have diversified to include developing countries. Opportunities in the modern services trade will grow as economic activities become more digitized and the world is more connected, though the pace will depend on progress made in reforming services trade restrictions in developed and developing countries alike. Areas for reform often include local registration, licensing, monopolist structures, capital controls, and requirements for local partnerships and residency.

Exploiting the potential of Asian countries for modern services exports requires different policy, regulatory and infrastructure reforms than those required for manufacturing. ICT infrastructure and well-trained graduates are the basic ingredients for IT and IT-enabled modern services exports. These alone would be sufficient for countries like Bangladesh and Pakistan, as they search for their niche in a competitive global market. For established players like India on the other hand, continuous innovation will be required to move up the value chain and achieve sustainable growth.

Other factors, including close business contacts between trading partners, the presence of a diaspora, inward foreign direct investment, domestic-led growth and regulatory reforms related to services, are important for modern services exports. There is a need to engage more actively on services-specific commitments in trade negotiations at multilateral and bilateral levels. Lastly, services should also be an integral part of regional integration efforts in Asia.