Promoting manufacturing investment in Lao PDR

In recent years, and particularly following its accession to the WTO in February, foreign investors have turned their attention to Lao PDR. Though increasing trade and investment flows remain concentrated in the natural resource sector, they also offer Lao PDR the opportunity to actively promote export diversification and investment in manufacturing. Below, I suggest three critical policies that can promote this transformation.

FDI Flows in Lao PDR

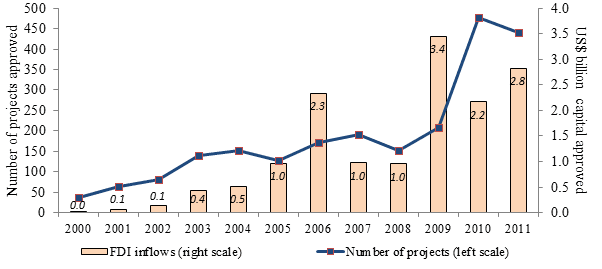

Lao PDR has been successful in attracting foreign investment over the past decade. FDI inflows sharply rose from 36 projects valued at $0.02 billion in 2000 to 441 projects with a value of $2.8 billion in 2011 (Figure 1). The investment peak in 2010 was the result of the implementation of a large hydropower project. In 2010, 476 new projects were approved. We might expect this to increase given that the World Bank’s Doing Business indicators show that the investment environment has improved since 2010.

Figure 1. FDI Inflows Approved in Lao PDR, 2000-2011

Source: Author’s compilation using data from the Lao Statistics Bureau.

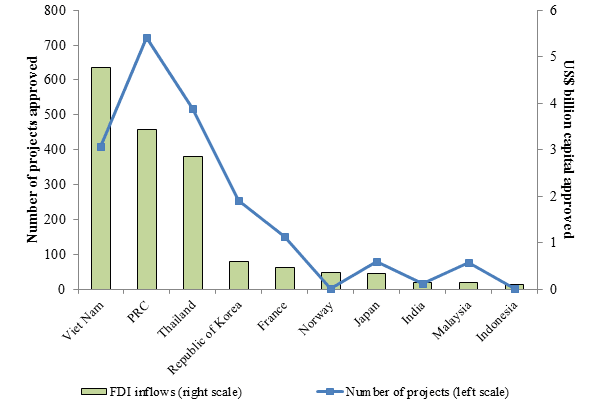

Unusually, investment in Lao PDR comes primarily from other developing countries. As shown in Figure 2, Viet Nam, the People's Republic of China (PRC), and Thailand account for more than 70% of FDI inflows, while Japan makes up less than 4% both in terms of the number of projects and the total value of FDI stock. This suggests that Lao PDR can capture important gains from the increasing global trend of South-South investment.

Figure 2. Geographical Distribution of FDI Stock in Lao PDR, 2000-2011

Source: Author’s compilation using data from the Ministry of Planning and Investment of Lao PDR.

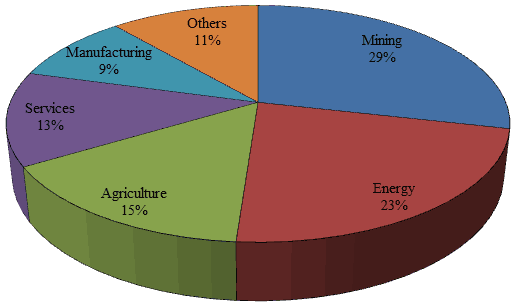

In terms of sectoral distribution, investment remains concentrated in natural resources. The largest recipient of FDI is the mining sector (29% of total FDI stock), followed by the energy sector (23%). In contrast, investment in the manufacturing sector makes up only a tiny share of total FDI, hovering around 9%. This is particularly important because while sectors involved in natural resources receive more than half of total FDI inflows, they employ only 0.4% of the total labour force. In contrast, the manufacturing sector absorbs about 7.3% of the labour force.

These trends show that Lao PDR is becoming an increasingly popular investment destination. However, given the tiny share of foreign investment in the manufacturing sector (Figure 3), rising investment inflows are likely to have only limited impact on job creation. As a result, complimentary domestic policies are needed to ensure that further FDI contributes to employment and sustainable economic growth.

Figure 3. Sectoral Distribution of FDI Stock in Lao PDR, 2000-2011

Source: Author’s compilation using data from the Ministry of Planning and Investment of Lao PDR.

How can Lao PDR attract manufacturing investment?

In order to best capture the gains from its growing role in the regional economy, there are three policies that can promote investment in the manufacturing sector. Putting all of these together will create a domestic business environment that is conducive for transnational operations in manufacturing.

The first policy is to continue the efforts to improve the domestic physical infrastructure. This will enable Lao PDR not only to enhance the competitiveness of domestic firms, but also to continue to attract FDI. Better infrastructure will lower trade costs which are currently a critical constraint due to Lao PDR’s small country size.

A related policy recommendation is to launch initiatives on public-private partnerships. This type of collaboration between the public and the private sector can serve as an engine to facilitate trade and investment. It can both overcome skill limitations within the government and also provide opportunities for domestic firms in target sectors.

Thirdly, Lao PDR needs to invest more in human resource development in order to attract manufacturing firms that require skilled labour. While statistics show that the quantity of education in Lao PDR is improving, in order to ramp up skills in the medium term, the government might consider vocational schools for training and re-training of the labour force capable of working in industries which are associated with regional and global value chains.

In conclusion, as a new WTO member in an increasingly dynamic region, Lao PDR has an opportunity to transform the domestic economy in ways that favour job creation and domestic investment. These three policy recommendations can improve the likelihood that the domestic economy can capture the gains available from increasing investment flows.