A soft revolution of mobile money in Pakistan: A pathway to financial inclusion

Over the past decade, there has been a rapid expansion of mobile money (m-money) networks in developing countries. These are largely intended to help financial services reach unbanked populations. This innovation has been taken up by cellular mobile companies in Pakistan, in partnership with domestic financial institutions, and thus creating some innovative business models for the use of m-money. While these innovations are a positive step forward for greater financial inclusion in Pakistan, a national strategy is essential to facilitate targeted and coordinated efforts between regulators and the private sector.

The challenge of high financial exclusion

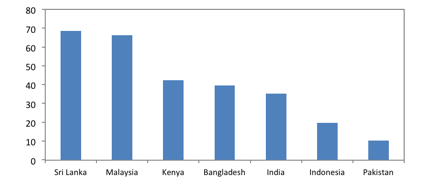

Despite comprehensive financial sector reforms in Pakistan, progress on financial inclusion has been slow. In 2011, only 10% of Pakistan’s adult population had accounts at formal financial institutions (Figure 1). In comparison, 68.5% of the adult population in Sri Lanka had bank accounts, whereas this figure is 39.6% in Bangladesh and 35.2% in India.

|

Figure 1. Percentage of Population (% age 15+) with account at a formal financial institution - 2011 |

|

|

Source: Financial inclusion database (Global Findex), The World Bank |

The expanding m-money networks and financial inclusion

Pakistan’s m-money infrastructure has expanded rapidly since the launch of the first domestic initiative in October 2009. This expansion has been promoted by a liberal financial and telecommunications regulatory framework, and active private sector participation. Four out of five cellular mobile companies currently operating in Pakistan have launched m-money systems in partnership with financial institutions. The m-money market volume has reached 153 million annual transactions worth US$ 6.2 billion.

There are two ways through which m-money services are provided in Pakistan. More than 95% of m-money transactions are carried out through mobile banking (m-banking) agents, and the rest are processed directly through customers’ mobile-wallet (m-wallet) accounts, using mobile phones. M-banking agents (retail points) provide the basic infrastructure for Pakistan’s m-money services, whereas customers’ m-wallet accounts currently have a limited role in the m-money services market.

|

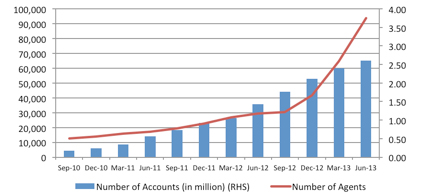

Figure 2. Number of m-banking agents and m-wallet accounts |

|

|

Source: State Bank of Pakistan |

In Pakistan, m-money services can improve access to financial services for the unbanked population, which is something which traditional banking channels have not managed to do. The network of 93,864 m-banking agents against only 10,250 commercial bank branches in the country provides a perspective as to the reach m-money has on the un-banked and poor.

The current high rate of dependence on agents to complete mobile transactions is typical in the initial adoption of m-banking. Moving forward, the importance of m-wallet accounts cannot be neglected. Many financial services including savings, insurance and micro-credit can be delivered through m-wallet accounts, which provide a store of value. As of June 2013, there were only 2.6 million m-wallet accounts, which is not large enough to reduce the high level of financial exclusion in Pakistan. Three new players that started operations in 2013 are relying solely on agent-based m-money services, while neglecting the potential of m-wallet accounts.

The way forward

Pakistan, with a population of 180.7 million, is home to 130 million cellular mobile subscribers. Almost 90% of Pakistani households have access to mobile communication services and access does not differ much by geography or income status. The widespread availability and adoption of mobile communication offers great opportunities to use m-wallet accounts for financial inclusion, however, this is conditional on the adoption of a comprehensive national strategy to transform current m-money models to account based m-banking. Coordinated efforts and well-defined responsibilities among important stakeholders including financial and telecom regulators, financial institutions, and cellular mobile operators are essential.

Existing m-money services in Pakistan are improving but remain very basic. Service provision is not yet sufficient to address the need for greater financial inclusion of the un-banked and poor. While the m-money network is expanding, the industry should introduce innovative products including savings, insurance and credit, that is tailored to the needs of potential users. Micro-finance institutions could further leverage the m-money infrastructure for their operations. In addition, creating awareness for the services and the education of the customers are equally important in order to encourage the use of m-money beyond just transfer of funds.

A more rapid uptake of m-wallet accounts could be facilitated by improving the regulatory framework and offering incentives for the private sector to shift the focus to account-based m-banking. Regulators should facilitate the market via a clear framework for m-banking transactions together with the use of various technical platforms for secure and less costly m-banking. Although branchless banking regulations have been in place since 2008, the supporting setup of m-banking structure in the country is still a work in progress. The long-awaited framework for the technical implementation of m-wallet based m-banking should be issued in a timely manner by financial and telecom regulators. Such regulatory foresight will help in developing commercially viable business models for financial inclusion.