Does exporting raise firm innovation?

Evidence supporting exporters as more productive than non-exporters is well documented, but evidence on why or how they become more productive is less conclusive. Exporters may be more productive simply because only the more productive firms choose to export—the selection effect—and therefore exporting per se does not contribute to greater productivity. In contrast, the learning-by-exporting effect argues that exporting in itself is important because it is through market interactions with foreign competitors, suppliers, and customers that firms become more productive.

Our previous blog provided evidence from the People’s Republic of China (PRC), which shows a lack of learning-by-exporting effect in many sectors, particularly in electronics, the PRC’s main export industry. On the other hand, evidence supporting the selection effect is more conclusive. These results are hardly surprising considering the dominance of the processing (assembly) trade in the PRC’s exports, which by its very nature is not highly productive. More than 50% of the PRC’s total exports, and over 80% of electronics exports, are processing trade.

Now, we ask the question of whether exporters innovate more than non-exporters in the PRC. If so, exporting should be a boon to growth because innovation is essential to achieving greater productivity.

The importance of innovation is well-recognized by the PRC’s policy makers. Clearly the country’s existing growth model based on high investment and cheap labor has created a whole host of problems from economic (imbalance among growth drivers), social (gaping income inequality), to environmental (degradation and pollution) .

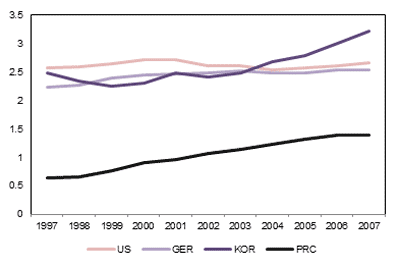

R&D expenditure in the PRC has risen strongly in recent years from US$6.1 billion in 1997 to US$48.8 billion in 2007, but its share of gross domestic product (GDP) has remained small (see figure). This implies that there is significant room for increased R&D spending as well as potentially untapped economic growth.

R&D Expenditure as Share of GDP (%)

GDP = gross domestic product, GER= Germany, KOR = Republic of Korea, PRC = People’s Republic of China, and US = United States.

Source: World Development Indicators, World Bank.

Using firm-level data from the PRC’s National Bureau of Statistics that focuses on 311,223 firms in the manufacturing sector, we find exporters indeed innovate more than non-exporters. Specifically, we find R&D intensity (defined as R&D expenditure over sales revenue) is 5% higher among exporters, R&D expenditure is 33% greater, and exporters are also 4% more likely to engage in R&D.

Great care was taken to address the potential reverse causality from R&D to exporting by using a matching estimator, and also to correctly measure productivity in the estimation. This was done in addition to including the standard set of controls such as firm scales and dummies for sector, province, and ownership.

Interestingly, we also find exporters in capital-intensive industries and domestic firms (whether state- or privately-owned) innovate more. On the other hand, exporters in processing intensive industries, such as electronics, firms located in coastal regions, and foreign-owned firms tend to innovate less.

The latter finding is not unexpected. Besides the overwhelming share of electronics in the processing trade, as mentioned above, electronics exports are also dominated by foreign-owned firms (more than 90%), and these firms are mostly located in coastal provinces. The labor-intensive component and final assembly nature of production, and the dominance of foreign-owned firms highlight the existence of a narrow technology gap between the PRC and the world’s frontier in this segment of the industry. As such, given that foreign-owned firms are already near the technology frontier, there is less motivation for them to innovate compared to domestic firms, consistent with the technology gap theory.

These results lead us to key policy suggestions in two areas. First, better protection of intellectual property rights, especially in enforcement, should be considered. This directly addresses the main concern of foreign firms, which often seek assurances prior to accelerating the transfer of more advanced technology to the PRC. At the same time, as Chinese firms become technology leaders in their own right, they will also benefit from better intellectual property protection.

Second, processing exports have low levels of innovation and domestic value-added, a fact clearly recognized by the country’s policy makers, which underscores the urgent need to move up the value chain in industries such as new generation information technology, energy conservation and environmental protection, and high-end manufacturing. While our findings show domestic state-owned firms tend to innovate more than privately-owned firms, going forward, greater effort should be made to allow private firms to flourish.

No doubt the reform of Chinese enterprises has come a long way, but much work remains to be done. If not, the danger is that the status quo will perpetuate various structural, regulatory, and institutional ills. And eventually this will derail the country’s ultimate objective of economic transformation to improve the people’s standard of living in the most efficient and equitable way possible.