Does exporting raise firm productivity?

No reasonable economists would disagree that trade openness and productivity is good for growth. Empirical support for trade openness as having a positive causal relationship with growth is overwhelming. As for productivity, Paul Krugman puts it as "... isn't everything, but in the long-run it is almost everything. A country's ability to improve its living standards over time depends almost entirely on its ability to raise its output per worker."

If productivity is key to raising living standards, and if trade openness raises income, then trade openness must also raise firm productivity. Yet at the micro firm-level, the relationship between trade openness, or exporting in particular, and productivity remains unsettled.

Evidence does show that exporters are more productive than non-exporters, but whether it is their decision to export that makes them more productive is less clear. Exporters may be more productive simply because only the more productive firms export—the selection effect. This is different from the notion that exporting raises productivity as firms learn through their interactions with other foreign competitors, customers, and suppliers, new and better ways of doing things—the learning-by-exporting effect.

Knowing the difference helps to shape policy focus in better allocating scarce resources. If selection effect is important, policies should focus more on fundamental issues, such as removing the costs and barriers of setting and doing business, as well as facilitating competition. On the other hand, if the learning-by-exporting effect matters, policies like trade finance, trade facilitation, trade liberalization, and trade agreements—that promote export or trade in general—will be important.

Empirically, there is evidence supporting both these effects. A survey of the relevant literature finds that a majority of studies supports the selection effect, but not the learning-by-exporting effect. Still, studies on firms in developing and transitional economies in the Republic of Korea, Indonesia, Slovenia and Africa have supported learning-by-exporting. So it may still be true that firms from less developed countries which are less sophisticated have a lot to learn and much to gain from exporting.

What about the experience of the People’s Republic of China (PRC), the world’s largest exporter and the world’s manufacturing hub? Given its labor abundance and technological backwardness, one could think that exporting is good for firm productivity. Evidence, however, suggests the contrary, and with good reasons.

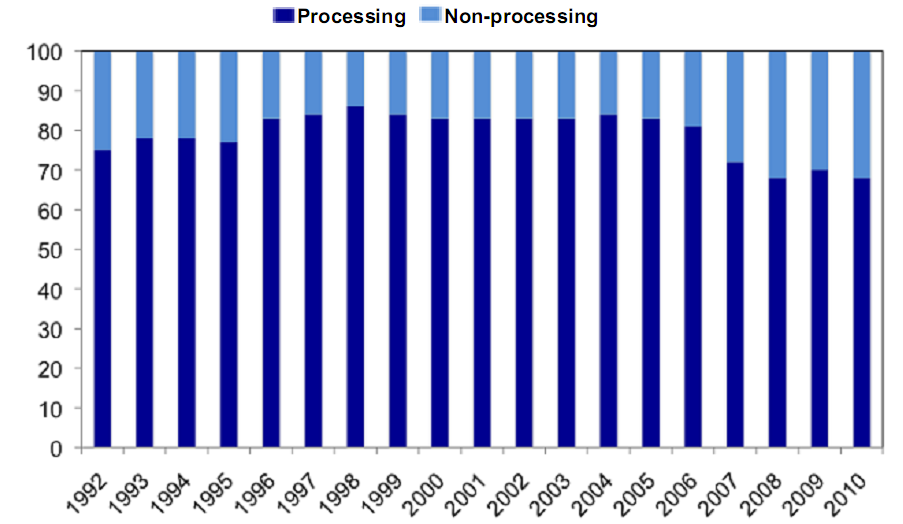

Figure 1. Share of Processing and Non-processing Exports in PRC’s Electronics (%)

Source: Authors’ calculations based on PRC Customs data.

A large study of over 130,000 firms in the PRC by one of the authors finds that there is no significant learning-by-exporting within many sectors, notably electronics, the main exporting sector representing over 60% of the country’s exports. Other studies also find no significant learning effect in the automotive sector and separately within foreign-affiliated firms, in contrast, there is significant learning effect in domestic exporting firms.

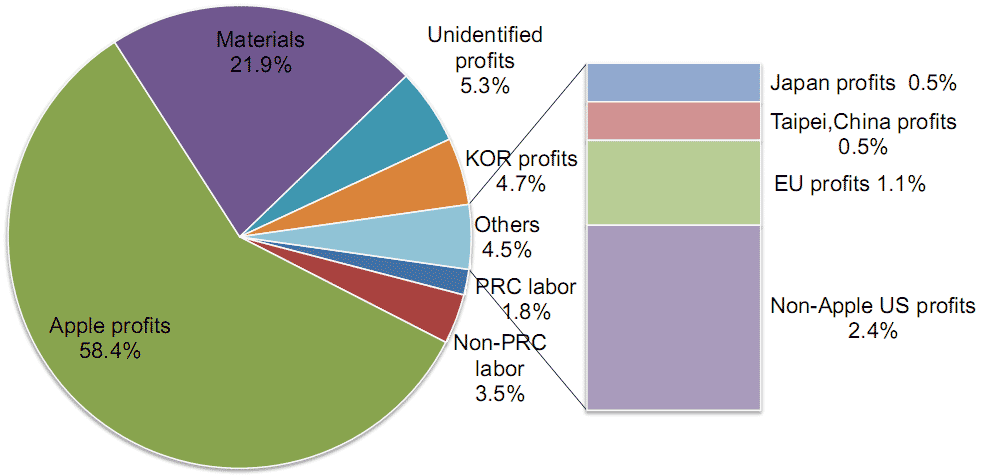

Closer investigation explains why. Half of PRC’s exports is dominated by processing or assembly trade, which by its very nature is not highly productive. For the electronics sector, the proportion is even larger at over 70% (see Figure 1). And within that sector, foreign affiliated firms dominate processing trade, representing over 90% of the sector. In addition, the domestic value-added in processing exports is on average about 20%, far below the 90% in non-processing exports. The iPhone example is instructive. For an iPhone 4 that retails at $549, only $10 or 1.8% of the value is attributed to domestic PRC labor input (see figure 2).

Figure 2. iPhone: Distribution of Value

EU = European Union; KOR = Republic of Korea; PRC = People’s Republic of China; US = United States.

Source: Kramer et al. 2011.

While exporting does not seem to boost productivity and contribute much to domestic value-added, it has provided jobs for the country’s massive labor force, thus maintaining social and political stability.

Looking ahead, efforts should be made to expand non-processing and higher value-added activities. In particular, private domestic firms should be facilitated to grow and export. These firms are the backbone of the country’s employment base, and industrial output, and they also add more domestic value to exports than foreign affiliated firms or state-owned firms. Given the unfavorable economic and financial treatment they continue to face vis-à-vis state-owned firms, policies that encourage the selection and/or learning-by-exporting effects can easily be introduced to reap the fruits of higher productivity to sustain economic growth.