Firm export behavior in developing countries: Evidence from India

Interest in firm heterogeneity and firm internationalization has grown exponentially since the path-breaking work of Bernard and Jensen (1995), which established that exporters perform better than non-exporters. There are two sides to export behavior, with one side suggesting that productive firms get induced to export (self-selection of inherently more productive firms). On the other side, policy makers believe that firms can learn to be more productive by exporting. For India, it appears that the evidence supports the self-selection of firms.

Policy makers have long believed that firms can learn by exporting through channels such as exposure to better technology and high quality products, increased competition in foreign markets, increase in scale of operations etc. This line of reasoning suggests that firms experience high productivity growth after entering export markets.

The empirical evidence for self-selection and learning by exporting now spans many developed and a few developing countries. A survey of the literature reports that most studies have found evidence for self-selection, while the debate on post-entry productivity growth remains inconclusive. Many authors have argued that the reason that post-entry studies often find only insignificant result is due to heterogeneity in learning based on firm characteristics such as age and export intensity. Alternatively, firms might invest in new technology or improve product quality before entering foreign markets to be able to compete internationally i.e. they might be learning to export, instead of learning by exporting.

The case of India

While developed countries internationalized early in the 1800s, India opened its current account in the early 1990s. Indian exports as a percentage of Gross Domestic Product (GDP) swelled from a mere 6.8% in 1990 to 21.9% in 2011. At the firm level (using data from the Center for Monitoring Indian Economy Pvt. Ltd. [CMIE]-prowess), the mean export to sales ratio increased from 9.3% in 1990 to 22.1% in 2011. We use this firm-level data of 10,685 Indian firms over the period between 1989 to 2011 to examine evidence for either self-selection or learning by exporting.

Of these firms, 527 switched from domestic to exporter status and 1694 firms remained purely domestic firms. The large pool of export starters and non-exporters offers a great opportunity to conduct a laboratory like experiment, wherein we matched export starters to 'similar' non-exporters and calculated the premium exporters enjoyed because of participating in international markets. The premium, in terms of productivity and size growth, was calculated at a one, two, and three year horizon after the date of entry into export markets. Through this we found that:

- Self-selection: Prior to entry, export starters are more productive compared to non-exporters. They are also larger, pay higher wages and younger before entry.

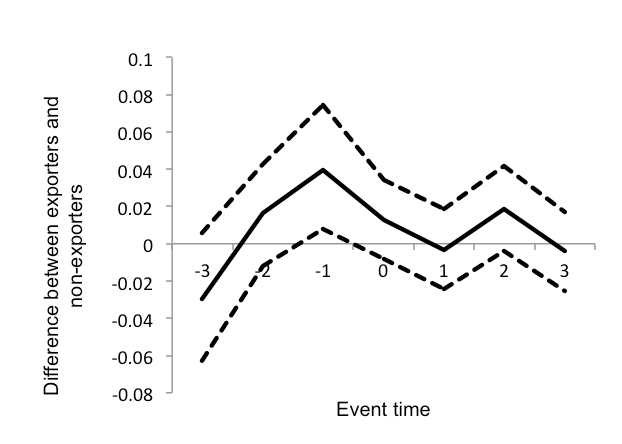

- No learning by exporting: The productivity growth of export starters after entry is not superior to non-exporters. This is seen in figure 1. (The solid black line is the estimated difference in productivity growth of export starters and similar non-exporters. The dotted black lines show the confidence interval. The y axis is the event time, where 0 is the date of entry, 1 is one year after, -1 is one year prior to entry and so on. We see that there is no significant difference in productivity growth after entry.)

Figure 1: Productivity Growth

- Learning to export: Export starters experience a significant boost in productivity one year prior to entry as compared to the non-exporters (See black line at event time -1 in figure 1).

- No heterogeneity in learning by exporting: There is no significant growth in productivity after entry when we disaggregated firms either by age, export intensity, size or level of productivity.

- High growth: Export starters grow bigger at a significantly higher rate compared to similar non-exporters, both before and after entering foreign markets.

Policy implications

For policy makers, these findings have several implications. Evidence in favor of self-selection of firms and learning to export suggest that policy should focus on enabling firms to improve their productivity by reducing the distortionary costs of government intervention, investing in infrastructure, promoting investment in R&D etc. The higher the productivity of firms, the more likely they are to export and compete in global markets.

Also, since we find that firms grow faster after entering export markets, the gradual increase in market share of these firms force less productive firms to exit. This reallocation of resources towards more productive firms should propel growth in the economy. Moreover, lack of evidence in favor of learning by exporting suggests that trade missions and trade liberalization cannot solely lead to growth in productivity of firms.

Thus, the focus of policy should be to push for a more conducive environment for business, reduce costs of operation, and hence promote firm productivity. This would help to increase global competitiveness and lead to overall growth of the economy.