Services trade on the road to the ASEAN economic community

The Members of the Association of South East Asian Nations (ASEAN) aim to establish a region-wide economic community by 2015. In achieving this, there are strong reasons, both internal to ASEAN’s integration process and linked to the region’s deepening ties with its external economic partners, to believe that service sector reforms, and in particular trade and investment in services, will rank highly on the region’s policy priorities.

The region’s rapid economic advance in recent decades was anchored in a growth model driven by external demand and insertion in global (regional) value chains, particularly in manufacturing. Such progress would not be possible without significant improvements in the efficiency with which the region’s underlying services infrastructure has sustained productivity growth in downstream industries. This however has resulted more from unilateral policy benevolence than from concerted collective action initiatives.

Challenges in achieving the AEC

The road to the ASEAN Economic Community (AEC) is paved with challenges. These include the need to move up value chains and escape the “middle income trap.” It also entails coping with an ongoing demographic transition and a growing (and restless) middle class. Moving forward, ASEAN Members States (AMS) have to rebalance continued dependence on external markets with consumption-based growth and shift towards a more service-centric development model.

AMS also face the additional task of devising policies flexible enough to accommodate and reconcile steep gaps in income levels and implementation capacities. The region’s reliance on progressive integration and variable geometry approaches should continue to serve it well. Such flexibility is important given that service sector reforms and trade raise complex issues, for which the strengthening of regulatory institutions and enforcement capacities are key.

A policy agenda for meeting AEC targets in services trade

Two distinct policy challenges will need to be addressed in the services field. First, AMS will need to update their collective rulebook under the ASEAN Framework Agreement on Services (AFAS). This should be done similarly to the facelift performed in the investment field a few years ago through the adoption of the ASEAN Comprehensive Investment Agreement.

AMS cannot meet integration targets set in services trade without revisiting the incomplete and outdated set of rules governing the sector. An exercise aimed at embedding best practices in services regulation is overdue. Many of these rules are practiced by ASEAN (as a group, and as individual member nations) under various preferential agreements with key trading partners since AFAS was devised in 1994. Such a facelift could anchor the region’s deep integration process through a modern and comprehensive set of disciplines rooted in the economic realities of IT-driven trade in tasks.

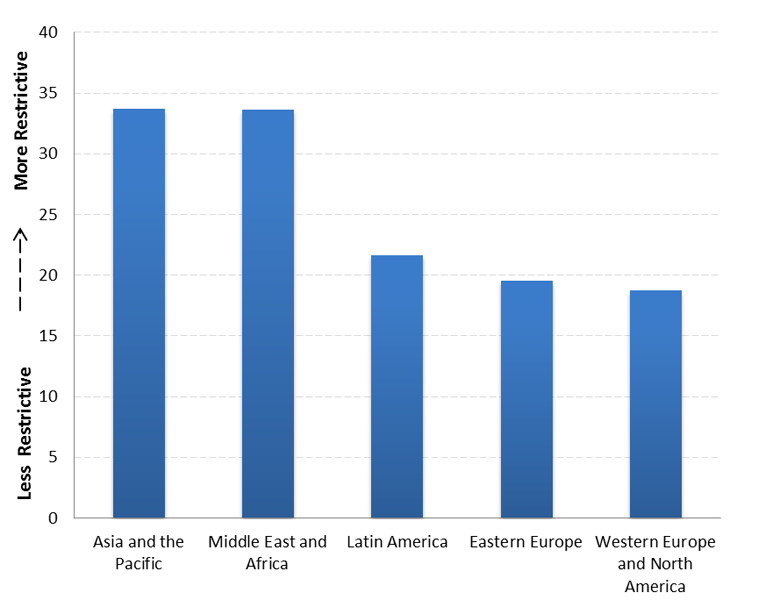

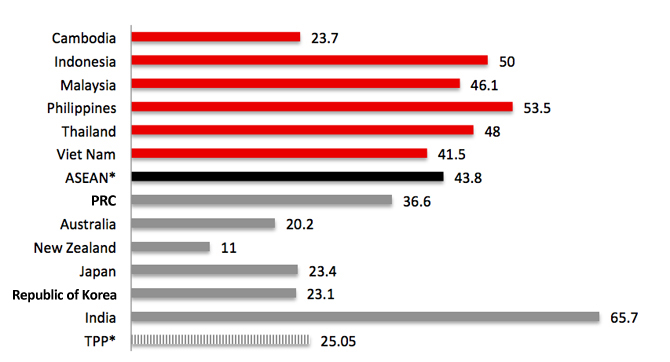

Secondly, AMS need to raise the bar on services liberalization. Despite the progress achieved in the various market opening packages pursued (but not always fully implemented) under AFAS, the region still exhibits high levels of restrictiveness in services trade and investment (see Figures 1 and 2). Not only does this contradict the aims of the AEC, it also acts as a potentially punitive tax on region-wide economic efficiency. The fact that AMS wish to cap intra-ASEAN foreign equity limitations at 70% in the context of a completed AEC (rather than 100%) sums up such policy ambivalence.

Figure 1. Services Trade Restrictiveness Index (STRI)*: Regional Comparison

Figure 2. Overall Services Trade Restrictiveness Indices: ASEAN* and Major Partners

*Index figures range from 0 (fully closed market) to 100 (fully open market). Data for ASEAN and TPP excludes Singapore.

Source: World Bank, Services Trade Restrictiveness Index database, available at www.worldbank.org

Meanwhile, care is needed to ensure that the multiplicity of external liberalization initiatives pursued by ASEAN (e.g. RCEP) and by individual Member States (e.g. TPP, EU-Malaysia) in the services field do not afford third countries better access to ASEAN markets than that enjoyed by AMS under AFAS. In revising AFAS, AMS may wish to include a most favored nation (MFN) clause to avoid such risks, and for spreading regionally-agreed liberalization benefits with greater automaticity.

Moving Forward

AMS must question whether their institutional machinery is up to the task of achieving the AEC aims in services. ASEAN’s institutional DNA is a (deliberate) far cry from the supranational forms of pooled regulatory governance and policed liberalization practiced in the European Union (EU) in pursuit of a single market for services.

The lessons from the (still far from complete) six decade-old process of services liberalization in Europe suggest that AMS will need to brace themselves for bumps along the road, especially if they fail to align policy instruments and enforcement means to effect meaningful market opening.

This underlines the need to look at the AEC as a long-term journey in services liberalization, with 2015 as an important milestone to be characterized by significant learning by doing externalities and confidence building as the AEC progressively takes shape in an environment of marked diversity of incomes, capacities and collective preferences.