The resurgence of bilateralism and Asia’s evolving FTA landscape

When the 12-nation Trans-Pacific Partnership agreement (TPP) was signed in February 2016, mega-regional trade deals appeared well poised to define the future of international economic relations and shape global trade rules, relegating bilateralism or trade pacts between two economies to the backseat. However, US President Donald Trump’s executive order pulling out the US from the TPP may not only decimate the fate of this regional pact but also herald the formation of a new order for international trade regimes.

In the same executive order, the US expressed in no uncertain terms that future trade agreements will be pursued through “bilateral trade negotiations”. This pronouncement also endangers the future of the Transatlantic Trade and Investment Partnership, a mega regional trade deal between the European Union and the US that is undergoing negotiations.

Against the backdrop of rising bilateralism in the West, where does Asia stand? Is the region moving towards the same direction or is it charting its own unique course? Understanding the evolution of Asia’s FTA landscape holds the key to these questions.

Current state of play of Asia’s FTAs

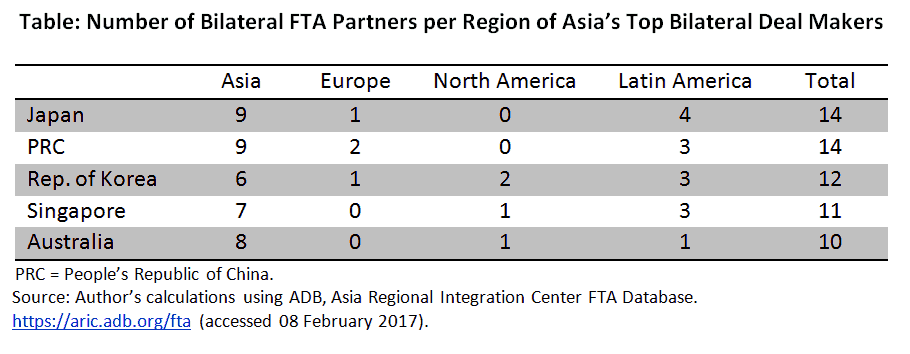

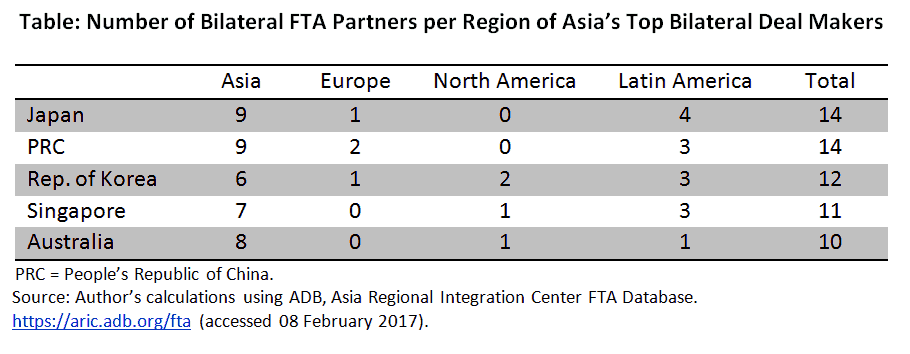

Among the 147 FTAs in force involving an Asian economy, 82% is bilateral, placing Asia in a unique position to reap early gains of this new trend. The key drivers of Asia’s bilateral FTAs are Japan, People’s Republic of China (PRC), the Republic of Korea, Singapore, and Australia (see table below). Overall, these five economies account for 44% of the region’s bilateral trade deals.

Japan and the PRC are the top bilateral deal makers in the region, while bilateral FTAs of the Rep. of Korea have the widest geographic reach spanning Asia, Latin America, North America, and Europe. All five economies, however, have non-Asian FTA partners. Australia, the Rep. of Korea, and Singapore are three of the only six economies that have bilateral FTAs with both the US and the PRC. The other three are Chile, Peru, and Costa Rica. The geographic diversity of the FTAs of the five economies including their choice of FTA partners illustrate the strategic nature of Asia’s bilateral trade deals, locking-in gains from trade with key trading partners and establishing new export markets.

Although bilateralism is prominent in Asia’s FTA landscape, other FTA forms thrive as well. For instance, all top five bilateral deal makers also have FTA ties with the Association of Southeast Asian Nations (ASEAN). Other regional trade blocs also exist such as the intra-regional South Asian Free Trade Area and the inter-regional Eurasian Economic Union (EEU) which consists of Central Asian economies Armenia, Kazakhstan, Kyrgyzstan and non-Asian members Belarus and the Russian Federation.

Evolution of Asia’s FTA landscape

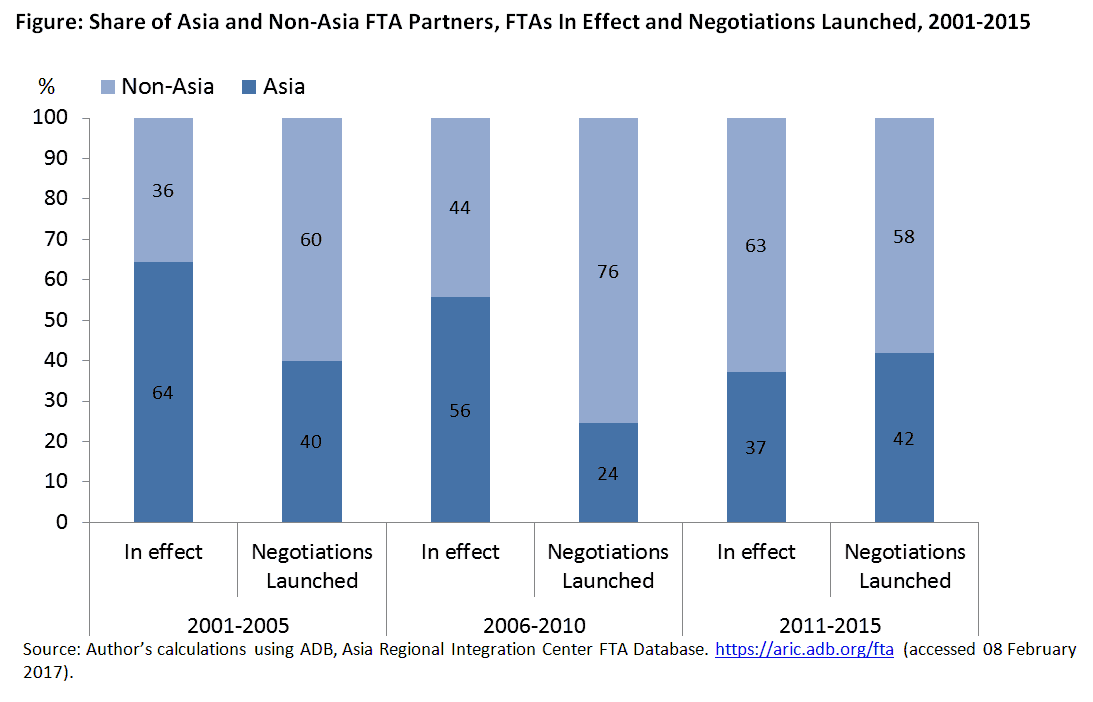

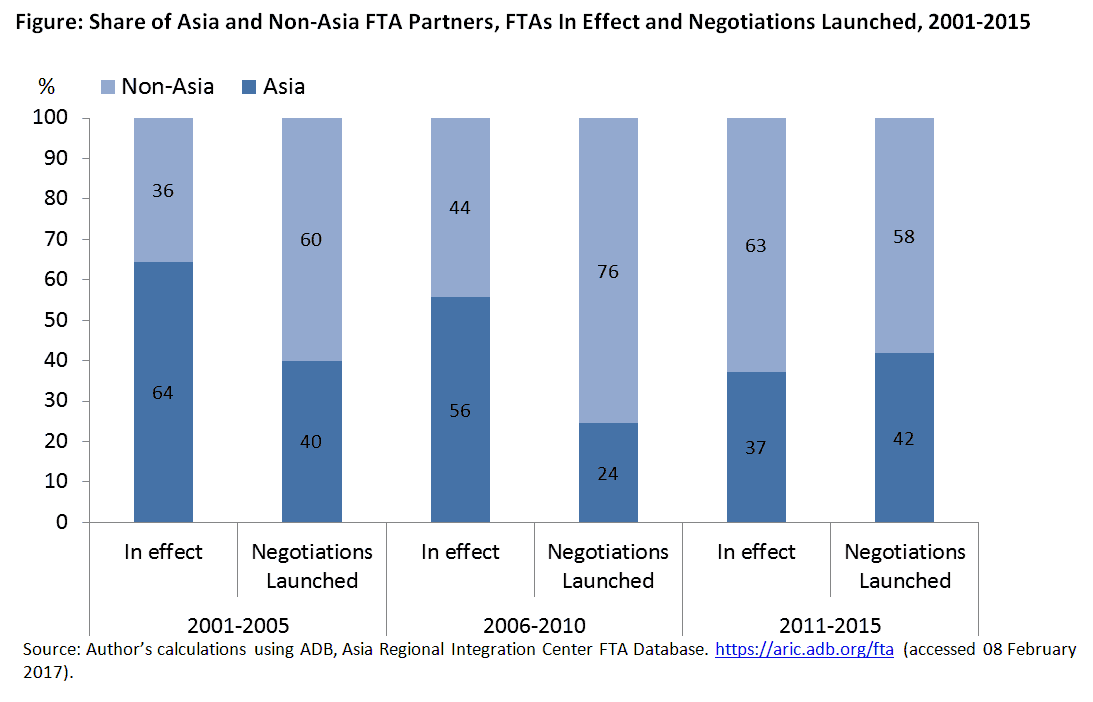

Majority of FTAs that have launched negotiations from 2011 to 2015 remains bilateral. However, the share of multi-country trade pacts that have launched negotiations has risen in the last ten years, from 36% in 2006–2010 to 44% in 2011–2015. The increase has been largely driven by the EEU and two non-Asia regional trade blocs – the EU and the European Free Trade Association (EFTA) - which launched FTA negotiations with individual Asian economies, mostly ASEAN members. Current trade negotiations of the EU and EFTA with Indonesia, the Philippines and Viet Nam, respectively are suggestive of a growing trend among advanced economies to form trade pacts with emerging Asian economies with high economic growth, demographic dividend, large domestic markets, and rising middle class.

Asia’s FTA landscape is also moving towards non-Asian partners, reflecting Asia’s strong orientation to open regionalism and its close link to global value chains. The share of FTAs in effect between Asian economies had dropped to 37% in 2011–2015 from 64% in 2001–2005 as more Asian economies entered into FTAs with European and Latin American partners (see figure below). This trend is expected to continue given that 58% of launched FTAs in the last five years were with non-Asian economies.

Amidst growing protectionist sentiment around the globe, Asia’s push for trade liberalism continues unabated. By pursuing both bilateral and multi-country trade pacts with economies within and outside the region, Asia keeps it FTA portfolio diverse and dynamic. Having been among the major beneficiaries of liberal trade regime, it isn’t surprising that Asia is taking necessary steps to promote freer international trade regimes.

When the 12-nation Trans-Pacific Partnership agreement (TPP) was signed in February 2016, mega-regional trade deals appeared well poised to define the future of international economic relations and shape global trade rules, relegating bilateralism or trade pacts between two economies to the backseat. However, US President Donald Trump’s executive order pulling out the US from the TPP may not only decimate the fate of this regional pact but also herald the formation of a new order for international trade regimes.

In the same executive order, the US expressed in no uncertain terms that future trade agreements will be pursued through “bilateral trade negotiations”. This pronouncement also endangers the future of the Transatlantic Trade and Investment Partnership, a mega regional trade deal between the European Union and the US that is undergoing negotiations.

Against the backdrop of rising bilateralism in the West, where does Asia stand? Is the region moving towards the same direction or is it charting its own unique course? Understanding the evolution of Asia’s FTA landscape holds the key to these questions.

Current state of play of Asia’s FTAs

Among the 147 FTAs in force involving an Asian economy, 82% is bilateral, placing Asia in a unique position to reap early gains of this new trend. The key drivers of Asia’s bilateral FTAs are Japan, People’s Republic of China (PRC), the Republic of Korea, Singapore, and Australia (see table below). Overall, these five economies account for 44% of the region’s bilateral trade deals.

Japan and the PRC are the top bilateral deal makers in the region, while bilateral FTAs of the Rep. of Korea have the widest geographic reach spanning Asia, Latin America, North America, and Europe. All five economies, however, have non-Asian FTA partners. Australia, the Rep. of Korea, and Singapore are three of the only six economies that have bilateral FTAs with both the US and the PRC. The other three are Chile, Peru, and Costa Rica. The geographic diversity of the FTAs of the five economies including their choice of FTA partners illustrate the strategic nature of Asia’s bilateral trade deals, locking-in gains from trade with key trading partners and establishing new export markets.

Although bilateralism is prominent in Asia’s FTA landscape, other FTA forms thrive as well. For instance, all top five bilateral deal makers also have FTA ties with the Association of Southeast Asian Nations (ASEAN). Other regional trade blocs also exist such as the intra-regional South Asian Free Trade Area and the inter-regional Eurasian Economic Union (EEU) which consists of Central Asian economies Armenia, Kazakhstan, Kyrgyzstan and non-Asian members Belarus and the Russian Federation.

Evolution of Asia’s FTA landscape

Majority of FTAs that have launched negotiations from 2011 to 2015 remains bilateral. However, the share of multi-country trade pacts that have launched negotiations has risen in the last ten years, from 36% in 2006–2010 to 44% in 2011–2015. The increase has been largely driven by the EEU and two non-Asia regional trade blocs – the EU and the European Free Trade Association (EFTA) - which launched FTA negotiations with individual Asian economies, mostly ASEAN members. Current trade negotiations of the EU and EFTA with Indonesia, the Philippines and Viet Nam, respectively are suggestive of a growing trend among advanced economies to form trade pacts with emerging Asian economies with high economic growth, demographic dividend, large domestic markets, and rising middle class.

Asia’s FTA landscape is also moving towards non-Asian partners, reflecting Asia’s strong orientation to open regionalism and its close link to global value chains. The share of FTAs in effect between Asian economies had dropped to 37% in 2011–2015 from 64% in 2001–2005 as more Asian economies entered into FTAs with European and Latin American partners (see figure below). This trend is expected to continue given that 58% of launched FTAs in the last five years were with non-Asian economies.

Amidst growing protectionist sentiment around the globe, Asia’s push for trade liberalism continues unabated. By pursuing both bilateral and multi-country trade pacts with economies within and outside the region, Asia keeps it FTA portfolio diverse and dynamic. Having been among the major beneficiaries of liberal trade regime, it isn’t surprising that Asia is taking necessary steps to promote freer international trade regimes.

*

Dorothea Ramizo is an economic analyst at the Economic Research and Regional Cooperation Department of the Asian Development Bank

Dorothea Ramizo is an economic analyst at the Economic Research and Regional Cooperation Department of the Asian Development Bank