Two ways to help revive tourism in Asia and the Pacific

Promoting domestic travel and using “travel bubbles” will help throw a lifeline to the region’s struggling tourism industry.

Tourism in Asia and the Pacific has been hit hard by the COVID-19 pandemic. International tourist arrivals fell by over 90% in many countries, compared to last year—and the situation is likely to persist, with the United Nations’ World Tourism Organization forecasting a drop of up to 80% over the whole year. An International Air Transport Association survey in June 2020 suggested that half of respondents would wait six months or more before traveling again. Clearly, recovery will take time.

In the many countries where tourism is an important source of foreign exchange earnings, the sudden fall in demand is having severe economic and social consequences within and beyond the tourism sector. Two strategies are being tried to revive the sector in the short run: promoting domestic tourism and using “travel bubbles”—an exclusive travel partnership among countries that have controlled the virus to allow tourism between them.

Promoting Domestic Tourism. The Philippines, for example, invested $8.5 million in a domestic tourism campaign in early 2020. In Viet Nam, domestic tourism shown a clear upward trend after the lockdown was eased. Travel bans and the fear of infection have meant that redirecting tourists, who ordinarily travel abroad, to domestic destinations could be a viable strategy. Many people still yearn to travel, but fear foreign and exotic places and wish to avoid mass transportation or are simply restricted by local lockdowns.

Across Asia and the Pacific, in more than half of cases, domestic tourism has the potential to fully replace foreign visitors. For example, in Armenia, outbound tourists exceed the number of inbound foreign tourists by 30%. This may not be the case, however, in countries that depend heavily on tourism, which would still face large gaps in demand even if they could fully mobilize domestic tourism.

Domestic tourism probably cannot fully replace foreign tourists for other reasons as well. For example, some people might not want to travel at all for fear of the pandemic. Social distancing and other containment measures are required even for domestic tourism, making it difficult to operate at the maximum level.

And overall demand for tourism has declined amid job losses and other loss of income in the pandemic. Finally, a gap may exist between the demand of domestic travelers and the supply of available tourism services. Some countries have successfully attracted high-income travelers from abroad, but the number of domestic tourists that can afford such high-end services might be limited.

Travel bubbles. These are agreements to open borders to nationals of a “travel bubble” partner country. Travel bubbles could be for business travel only or also include leisure travel. They often specify provisions on health protocols that need to be followed when leaving and entering the territory. Access can be reciprocal or only in one direction. They can be formed between two or more partners.

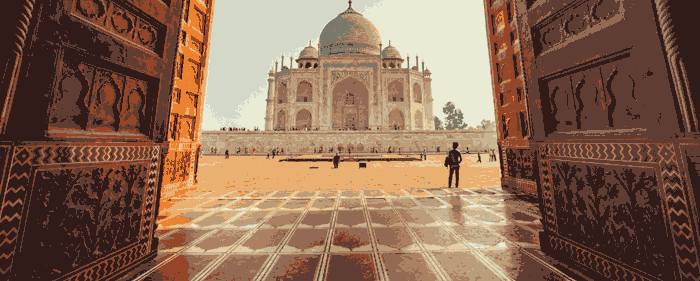

Prior to COVID-19, the tourism industry was one of the most dynamic sectors in Asia and the Pacific region.

The first travel bubble in Asia and the Pacific was established between the People’s Republic of China and the Republic of Korea on May 1, 2020. The agreement is limited to business travelers who need to be invited by a company in the receiving country. Visitors need to monitor their health for two weeks and get tested for the virus 72 hours before departure from their home country. Upon arrival, they are tested again and quarantined until the results are obtained. The two countries are currently discussing expansion of this program.

Travel bubbles are geared towards redirecting a substantial part of the partner countries’ international travelers. For example, another travel bubble under negotiation is the Trans-Tasman travel bubble between Australia and New Zealand. Given the strong links between the two countries, the agreement is expected to boost tourism in both, as similar COVID-19 status argues for an agreement. However, a recent outbreak in the Australian state of Victoria has stalled negotiations.

Other travel bubbles under negotiation aim to allow movement of cross-border commuters (Malaysia and Singapore) and tourists (the “Bula bubble” involving Australia, Fiji, and New Zealand).

Our research simulated possible travel bubbles. For example, most tourists in Fiji are from Australia. If Fiji opened to Australia, the gap left by international tourists that could not be filled by domestic tourists would fall from 84% to 44%, a significant reduction. For Thailand the gap would shrink from 68% to 46% if it opened to PRC. For this to happen, we assumed that the level of tourism would reach the pre-crisis level of 2018.

One challenge when negotiating travel bubbles is that the spread of the COVID-19 has not been brought under control in most economies. Tourists’ appetite to travel abroad also depends on the pandemic situation. The opportunity to open for bilateral tourism typically only arises once an economy and its partner are well beyond their peak of new infections. In addition to the pandemic itself, the preparedness to fight COVID-19 is another important consideration for tourists. Only a few countries in the region seem to be equipped to handle outbreaks swiftly and effectively.

Promoting domestic tourism might be a viable option for some countries, but for most it falls short. The other option, setting up travel bubbles, can also be challenging. As the pandemic remains unpredictable, maintaining the bubbles will not be a simple undertaking. Even with these two strategies, the tourism industry is therefore likely to struggle until a vaccine is widely available.

Prior to COVID-19, the tourism industry was one of the region’s most dynamic sectors. Once the pandemic is over, there are many reasons to believe that tourism will resume its vibrancy.

Original article was published at the ADB Blog and duplicated here with permission from the author. *