US Dollar: The slipping anchor

The world dollar standard is an accident of history that greatly facilitates international trade and exchange. Since 1945, the dollar has been the key currency used by governments, banks, and private corporations in invoicing commodity trade.

Although the strong network effects of the dollar standard greatly increase the financial efficiency of multilateral trade, it has few admirers. Erratic US monetary and exchange rate policies since the late 1960s have traditionally made, and continue to make, foreigners unhappy. A weak dollar led to the worldwide price inflations of the 1970s and contributed to the 2008/09 global credit crunch.

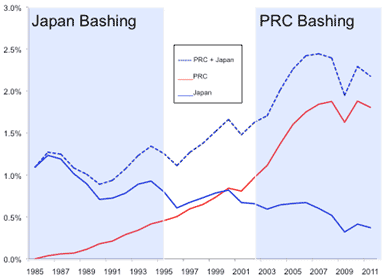

Ironically, the asymmetrical nature of the dollar standard also makes many Americans unhappy. Because the dollar is the central currency in the world system, foreign governments—particularly in Asia—naturally set their exchange rates against the dollar, which leaves the US without an exchange policy of its own. Americans then complain that foreign governments are setting their dollar exchange rates unfairly. Two cases in point are the Japan bashing from the late 1970s to the mid-1990s, and the current People’s Republic of China (PRC) bashing since 2002 over the alleged undervaluation of the yen and renminbi, respectively. In both cases, the US was running a large bilateral trade deficit with first Japan and then the PRC (see figure). But the US saving deficiency (fiscal deficit), and not the exchange rate, was to blame in each case.

Figure: Bilateral Trade Balances of Japan and the PRC versus the US (% of US GDP, 1985-2011)

Source: US Census Bureau.

We are therefore confronted with a great paradox. Although nobody is particularly enamored of the dollar standard, the revealed preference of both governments and private participants in the foreign exchange markets since 1945 has been to continue to use it.

Once established as international money, the dollar has become a “safe haven” in times of great international crises—even ones emanating from the US itself. In the credit crunch and global downturn of 2008 from the US subprime mortgage crisis, the resulting flight to safety sharply lifted the foreign exchange value of the dollar against most other currencies that were not tied to it. In the great euro banking crisis that began in 2011, there was another surge in the demand for dollars.

Notwithstanding the dollar’s robustness as a facilitator in surviving the calamities of the last few decades, its performance as the world’s monetary anchor has become abysmal. Since 1945, the US monetary policy has remained inward looking—neglecting feedback effects from the rest of the world—even as globalization since the 1960s has made such insularity obsolete.

To take only the most recent example, the US Federal Reserve’s current policy of keeping short-term interest rates near zero since December 2008 (and out of alignment with higher interest rates in emerging markets on the dollar standard’s periphery) has induced a flood of hot money into the periphery from mid-2009 to mid-2011. This has resulted in a loss of monetary control and worldwide inflation in primary commodity prices—particularly in food grains and oil. This bubble ended, probably just temporarily, when the advent of the European banking crisis cut off the flow of finance to speculators in both the foreign exchange and commodity markets.

To help overcome the insularity of American policies, the US Federal Reserve should (1) give more weight to stabilizing the dollar’s effective (multilateral) exchange rate, and (2) avoid creating large interest differentials between the “center” and the “periphery”. Beyond simply reacting to the immediate pressure of inflation or deflation within the domestic US economy, by following a more outward looking monetary strategy, the US would then be rewarded by positive feedback effects from the world that would make the US economy itself less inflationary and more stable.

Despite protestations that the government really wants a “strong” dollar, today’s weak dollar is tolerated because influential economists still believe that dollar devaluation will reduce the US trade deficit—the belief that motivates the bashing of the PRC to appreciate the renminbi against the dollar. This is particularly pernicious for global monetary stability when the central country in the world’s monetary system tries to depreciate its own currency.

Clearly, the presumption that unfettered US monetary and fiscal policies would lead to macroeconomic stability in the American economy—and by extension to the world economy—was wildly optimistic.

No wonder that foreigners—from the French in the late 1960s to the Chinese since 2008—have called for a new international monetary regime that is not so dependent on the vicissitudes of any one national currency, that is, the US dollar. But attempts to replace the dollar with a purely international money, as with issues of Special Drawing Rights (SDR) by the International Monetary Fund, have essentially failed to displace the dollar from its central position.

There is really no alternative but for nations to work together to rehabilitate the unloved dollar standard1.

1This essay abstracts some of the material in my book, The Unloved Dollar Standard: From Bretton Woods to the Rise of China, forthcoming from the Oxford University Press, January 2013.