What we learned about foreign direct investment in Asia (Part I)

Developing economies strive to attract foreign direct investment (FDI) to enhance economic performance. Countries adopt policies to improve the business climate, such as streamlining government procedures and relaxing foreign ownership rules in companies or even property, and improve infrastructure like ports, roads, telecommunications to facilitate doing business in the domestic economy. When done right, FDI is often associated with technology and superior skills that the host economy can assimilate and adopt in domestic industries. FDI can also contribute to higher economic growth and employment, including female participation in the formal economy. What are the significant findings about FDI in Asia? A recent study by ADB breaks down some of important results in the region.

Asia has been gaining importance as a source of FDI, accounting for more than half of FDI in the region in recent years.

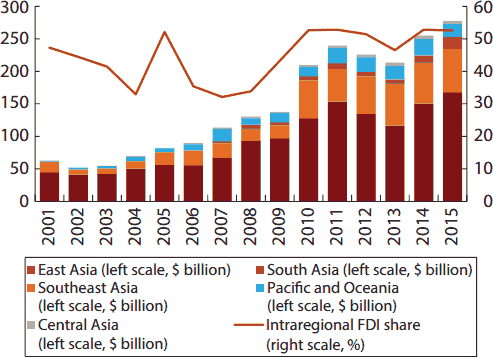

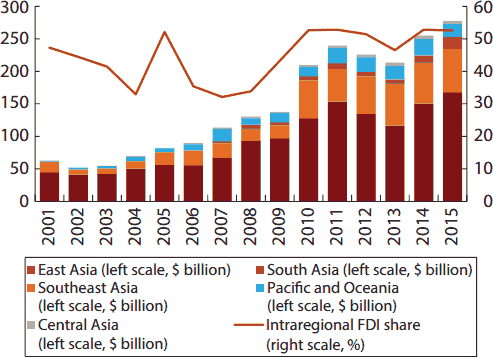

In the past, most FDI in Asia came from western economies, but the development of technology, human resources, and accumulation of capital in Asia have enabled advanced economies in the region to invest and set up production in neighboring countries. More importantly perhaps, increasing intraregional FDI—or foreign investments from Asian countries within Asia—is also attributed to the rise of global value chains (GVCs), where the production of a commodity, usually manufactured goods, is no longer confined to one country, but spread across different economies as different components are produced separately. Asia’s intraregional FDI share rose from 36% in 2006–2009 to an average share of 52% since 2010 (Figure 1). This pattern suggests that Asia is becoming more integrated with Asia than with non-Asian regions in investments. Intraregional FDI inflows are primarily driven by East Asia and, to a lesser extent, Southeast Asia. These two regions accounted for 60% and 24%, respectively, of intraregional FDI inflows in 2015.

Figure 1: Intraregional FDI Inflows—Asia

Source: ADB (2016), using data from Association of Southeast Asian Nations Secretariat; CEIC; Eurostat, Balance of Payments (accessed August 2016); and United Nations Conference on Trade and Development, Bilateral FDI Statistics (accessed August 2016).

Japan is the dominant source of GVC-FDI in Asia, while the PRC is the most popular host.

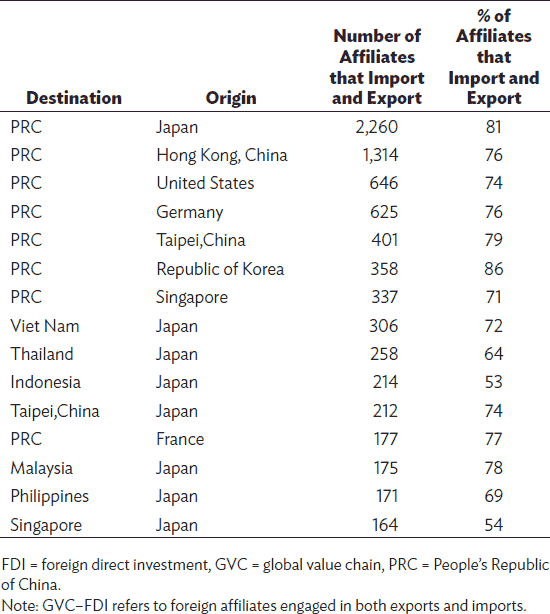

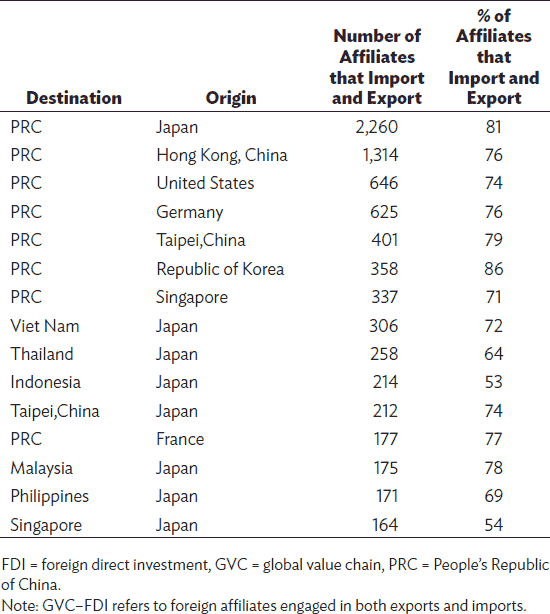

Multinationals play an especially critical role in investment flows. Not only are they the main organizers and coordinators of GVCs, but they also serve foreign markets by relocating the production process as an alternative to trade. The great trade expansion in developing Asia—before being disrupted by the global financial crisis—was propelled in large part by the regional and global value chains spawned by Japanese multinationals across developing Asia. Participating in GVCs has been key for greater trade and economic efficiency. It also facilitates better transfer of technology among firms along the supply chain while stimulating job creation and output performance. As of 2015 the PRC hosts the most GVC–FDI, not only from multinationals of Japan, the US, and Germany, but also Hong Kong, China; Singapore; and Taipei,China (Table 1). Almost 80% of foreign-owned plants in the PRC are engaged in exporting and importing, followed by Taipei,China (74%); Viet Nam (70%); Thailand (66%); and Malaysia (65%).

Table 1: Destination and Origin of GVC-FDI

Source: ADB (2016), using data from Dun & Bradstreet, D&B Worldbase.

Governance is the most important factor for attracting FDI, particularly mergers and acquisitions (M&As), and especially when the source is a high-income economy.

The quality of local governance exerts a highly significant and positive effect on both greenfield FDI (where foreign firms build production facilities) and M&As (where foreign firms acquire existing local ones). The same is true in Asia. Based on ADB’s estimation, if governance in the Philippines improved to the level of Malaysia, it would have received 80% more greenfield FDI and 120% more M&As (in terms of number of projects) from high-income economies over 2003–2015. Among the world governance indicators by the World Bank, the most critical governance sub-indicators for FDI attraction from high-income economies to developing ones are “regulatory quality” and “government effectiveness” for both greenfield investments and M&As, and especially for Asian hosts.

Where governance reforms take longer to achieve, developing economies can improve the business environment to expand prospects for FDI inflows.

The policy regime as reflected by the business environment appears to help attract FDI, particularly greenfield investments, especially for economies with low scores for governance. This does not mean, however, that improving the business environment can substitute for governance reforms. Improving the business environment is particularly important for economies still working to develop quality institutions, where reform takes time to implement fully. Among the doing business indicators by the World Bank, the most important aspect of the business environment for M&A is the ease of “getting credit”, while the ease of being able to “register property” matters most for greenfield investments. Multinationals from high-income economies are in general more responsive to the local business environment of developing hosts than they are to high-income hosts. Overall a good investment climate attracts both the productive domestic and foreign private investment that helps fuel growth and reduces poverty.

Reference and further reading:

ADB. 2016. Special Theme Chapter: What Drives Foreign Direct Investment in Asia and the Pacific? Asia Economic Integration Report. Manila: Asian Development Bank.

Developing economies strive to attract foreign direct investment (FDI) to enhance economic performance. Countries adopt policies to improve the business climate, such as streamlining government procedures and relaxing foreign ownership rules in companies or even property, and improve infrastructure like ports, roads, telecommunications to facilitate doing business in the domestic economy. When done right, FDI is often associated with technology and superior skills that the host economy can assimilate and adopt in domestic industries. FDI can also contribute to higher economic growth and employment, including female participation in the formal economy. What are the significant findings about FDI in Asia? A recent study by ADB breaks down some of important results in the region.

Asia has been gaining importance as a source of FDI, accounting for more than half of FDI in the region in recent years.

In the past, most FDI in Asia came from western economies, but the development of technology, human resources, and accumulation of capital in Asia have enabled advanced economies in the region to invest and set up production in neighboring countries. More importantly perhaps, increasing intraregional FDI—or foreign investments from Asian countries within Asia—is also attributed to the rise of global value chains (GVCs), where the production of a commodity, usually manufactured goods, is no longer confined to one country, but spread across different economies as different components are produced separately. Asia’s intraregional FDI share rose from 36% in 2006–2009 to an average share of 52% since 2010 (Figure 1). This pattern suggests that Asia is becoming more integrated with Asia than with non-Asian regions in investments. Intraregional FDI inflows are primarily driven by East Asia and, to a lesser extent, Southeast Asia. These two regions accounted for 60% and 24%, respectively, of intraregional FDI inflows in 2015.

Figure 1: Intraregional FDI Inflows—Asia

Source: ADB (2016), using data from Association of Southeast Asian Nations Secretariat; CEIC; Eurostat, Balance of Payments (accessed August 2016); and United Nations Conference on Trade and Development, Bilateral FDI Statistics (accessed August 2016).

Japan is the dominant source of GVC-FDI in Asia, while the PRC is the most popular host.

Multinationals play an especially critical role in investment flows. Not only are they the main organizers and coordinators of GVCs, but they also serve foreign markets by relocating the production process as an alternative to trade. The great trade expansion in developing Asia—before being disrupted by the global financial crisis—was propelled in large part by the regional and global value chains spawned by Japanese multinationals across developing Asia. Participating in GVCs has been key for greater trade and economic efficiency. It also facilitates better transfer of technology among firms along the supply chain while stimulating job creation and output performance. As of 2015 the PRC hosts the most GVC–FDI, not only from multinationals of Japan, the US, and Germany, but also Hong Kong, China; Singapore; and Taipei,China (Table 1). Almost 80% of foreign-owned plants in the PRC are engaged in exporting and importing, followed by Taipei,China (74%); Viet Nam (70%); Thailand (66%); and Malaysia (65%).

Table 1: Destination and Origin of GVC-FDI

Source: ADB (2016), using data from Dun & Bradstreet, D&B Worldbase.

Governance is the most important factor for attracting FDI, particularly mergers and acquisitions (M&As), and especially when the source is a high-income economy.

The quality of local governance exerts a highly significant and positive effect on both greenfield FDI (where foreign firms build production facilities) and M&As (where foreign firms acquire existing local ones). The same is true in Asia. Based on ADB’s estimation, if governance in the Philippines improved to the level of Malaysia, it would have received 80% more greenfield FDI and 120% more M&As (in terms of number of projects) from high-income economies over 2003–2015. Among the world governance indicators by the World Bank, the most critical governance sub-indicators for FDI attraction from high-income economies to developing ones are “regulatory quality” and “government effectiveness” for both greenfield investments and M&As, and especially for Asian hosts.

Where governance reforms take longer to achieve, developing economies can improve the business environment to expand prospects for FDI inflows.

The policy regime as reflected by the business environment appears to help attract FDI, particularly greenfield investments, especially for economies with low scores for governance. This does not mean, however, that improving the business environment can substitute for governance reforms. Improving the business environment is particularly important for economies still working to develop quality institutions, where reform takes time to implement fully. Among the doing business indicators by the World Bank, the most important aspect of the business environment for M&A is the ease of “getting credit”, while the ease of being able to “register property” matters most for greenfield investments. Multinationals from high-income economies are in general more responsive to the local business environment of developing hosts than they are to high-income hosts. Overall a good investment climate attracts both the productive domestic and foreign private investment that helps fuel growth and reduces poverty.

Reference and further reading:

ADB. 2016. Special Theme Chapter: What Drives Foreign Direct Investment in Asia and the Pacific? Asia Economic Integration Report. Manila: Asian Development Bank.

*