2016 ADB Conference on Economic Development:

The Role of Foreign Direct Investment in Economic Development

The Asian Development Bank (ADB) is holding its inaugural ADB Conference on Economic Development (ACED) in collaboration with The University of Hong Kong. ACED will be an annual exchange of knowledge and ideas amongst experts and researchers on key issues in economic development. ACED 2016 investigates how foreign direct investment (FDI) can foster inclusive economic growth and regional integration, and examines the factors that drive FDI most conducive for achieving development goals. This year's inaugural theme on the role of FDI in economic development will be further explored in the special theme chapter of one of ADB Economic Research and Regional Cooperation Department's flagship publications, the Asian Economic Integration Report 2016.

Event details

Date:

- 2–3 June 2016

Venue

- Room 315, 3/F, K.K. Leung Building, The University of Hong Kong (HKU)

Contacts:

-

- Fahad Khan

Economic Research and Regional Cooperation Department

Asian Development Bank

Email: fkhan@adb.org - Mitzirose Legal

Economic Research and Regional Cooperation Department

Asian Development Bank

Email: mlegal@adb.org - Pia Tenchavez

Economic Research and Regional Cooperation Department

Asian Development Bank

Email: ptenchavez@adb.org

- Fahad Khan

Download:

- Official Conference Program Booklet

Program and Agenda

Registration:

Registration / Opening

08:00–08:45 -

Registration and Coffee

08:45–08:55 -

Welcome Remarks

Eric ChangDean, Faculty of Business and Economics, The University of Hong Kong (HKU)

Eric ChangDean, Faculty of Business and Economics, The University of Hong Kong (HKU) 08:55–09:00 -

Opening Remarks

Shang-Jin WeiChief Economist, Asian Development Bank

Shang-Jin WeiChief Economist, Asian Development Bank

Session 1:

FDI in the Age of Global Value Chains

-

Chair

Cyn-Young ParkDirector, Regional Cooperation and Integration Division, Economic Research and Regional Cooperation Department, Asian Development BankBio

Cyn-Young ParkDirector, Regional Cooperation and Integration Division, Economic Research and Regional Cooperation Department, Asian Development BankBioCyn-Young Park is Director of the Regional Cooperation and Integration Division in the Economic Research and Regional Cooperation Department of the Asian Development Bank (ADB). She manages a team of economists to examine policy issues and develop strategies related to regional cooperation and integration (RCI). During her career with ADB, she has been main author and contributor to ADB flagship publications, including the Asian Development Outlook, as well as the Asia Capital Markets Monitor, Asia Economic Monitor, Asia Bond Monitor, and ADB Country Diagnostic Study Series. She has also participated in various global and regional forums, including the G20 Development Working Group, Association of Southeast Asian Nations (ASEAN), ASEAN+3, Asia-Pacific Economic Cooperation, and Asia-Europe Meeting. She has written and lectured extensively about the Asian economy and financial markets. Prior to joining ADB, she served as Economist (1999–2002) at the Organisation for Economic Cooperation and Development (OECD). She received her PhD in Economics from Columbia University, and bachelor degree from Seoul National University.

09:00 09:05 -

Session Opening

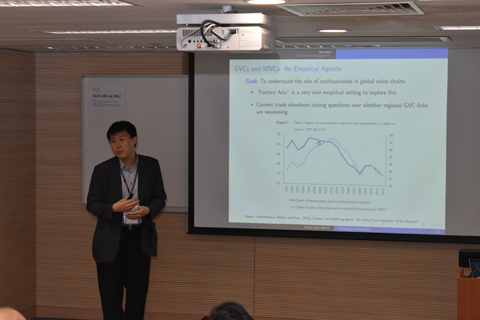

09:05 09:30 -

Factory Asia: The Determinants of Multinational Activity in the Context of Global Value Chains

Natalia RamondoAssistant Professor, University of California at San Diego

Natalia RamondoAssistant Professor, University of California at San DiegoNatalia Ramondo’s research interests are in international trade, with a particular emphasis on the behavior of multinational firms. Her research explores the determinants of multinational activities as well as their effects on recipient countries. Recently, she has focused on the dynamic behavior of multinational firms as well as the formation of global value chains. Her work has been published in major journals such as the American Economic Review and the Journal of Political Economy.

Natalia Ramondo received her PhD in economics at the University of Chicago in 2006. Before joining the School of Global Policy and Strategy at UCSD in the fall of 2013, she was assistant professor at University of Texas-Austin and Arizona State University. She was research fellow at Princeton University in 2009–2010. She has been a faculty research fellow at the National Bureau of Economic Research since 2015. At UCSD, she teaches international trade and topics on multinational corporations, both for masters and PhD students.

BioAbstractFull paperPresentationTraditionally, the literature has analyzed the determinants of horizontal activities

of multinational firms—which entail serving the host market—vis-a-vis vertical activities—which entail a form of production fragmentation and trade flows within—and outside—the boundaries of the firm. For the most part, past analysis have been restricted by data availability: When detailed data on affiliates’ activities were available, the coverage in terms of countries was small, and when data for a broad set of countries were available, the detail provided on the affiliates’ activity was very low.

This paper brings new evidence on the determinants of the activity of affiliates of multinational firms in Asia, in the context of global value chains. The analysis relies on a unique firm-level data set provided by Dun & Bradstreet (D& B) with good coverage of the countries in the region. The key feature of the data that makes the analysis possible is the information provided, at the firm level, on the firm’s engagement in international trade activities; in this way, affiliates can be classified as host-market oriented or exporters. The traditional country and industry determinants of different types of Foreign Direct Investment (FDI)—comparative advantage, trade costs, and economies of scale—can be tested in a very precise way for a large set of countries and augmented by production fragmentation considerations (i.e., input-output links) and measures of engagement of countries in the global value chain (e.g., measures of value-added trade and exports’ upstreamness).

09:30 09:40 -

Discussant

Davin ChorAssociate Professor, National University of SingaporeBioDiscussion

Davin ChorAssociate Professor, National University of SingaporeBioDiscussionDavin Chor is Associate Professor at the Department of Economics, National University of Singapore. His research interests are in international trade, political economy and economic history. His work in international trade focuses on understanding how institutional and policy forces affect patterns of comparative advantage and multinational activity. He presently serves as Associate Editor at the Journal of International Economics and the Review of International Economics. Davin completed his A.B. in Economics summa cum laude from Harvard University in 2000. He also holds an A.M. in Statistics (2000) and a PhD in Economics (2007) from Harvard.

09:4009:50 -

Open Discussion

09:50 10:15 -

Host-Country Financial Development and Multinational Activity

Davin ChorAssociate Professor, National University of Singapore

Davin ChorAssociate Professor, National University of SingaporeDavin Chor is Associate Professor at the Department of Economics, National University of Singapore. His research interests are in international trade, political economy and economic history. His work in international trade focuses on understanding how institutional and policy forces affect patterns of comparative advantage and multinational activity. He presently serves as Associate Editor at the Journal of International Economics and the Review of International Economics. Davin completed his A.B. in Economics summa cum laude from Harvard University in 2000. He also holds an A.M. in Statistics (2000) and a PhD in Economics (2007) from Harvard.

BioAbstractFull paperPresentationThis paper evaluates the influence of financial development on the global operations of multinational firms. Using detailed data from the United States, we provide evidence that host-country financial development increases entry by multinational affiliates, while also influencing affiliates’ incentives to sell in the local market, the parent country, and third-country destinations. We rationalize these patterns with a model that emphasizes the interaction of two effects of financial development: (i) a competition effect that reduces affiliate revenues in the host market due to increased entry by domestic firms, and (ii) a financing effect that encourages affiliate entry and activity in the host country.

* Co-Authors: L. Kamran Bilir and Kalina Manova

10:1510:25 -

Discussant

Xuehui HanEconomist, Asian Development BankBioDiscussion

Xuehui HanEconomist, Asian Development BankBioDiscussionXuehui Han is Economist in the Economic Research & Regional Cooperation Department of the Asian Development Bank (ADB). She was on the faculty of Fudan University's School of Management in the People's Republic of China before joining ADB. She holds a PhD in economics from the University of Oslo and a Bachelor’s degree in accounting from Fudan University. She has considerable research expertise in international macroeconomics, finance, economic growth, and real estate economics, with several publications in international journals.

10:2510:35 Open Discussion

10:35 10:50 Coffee break

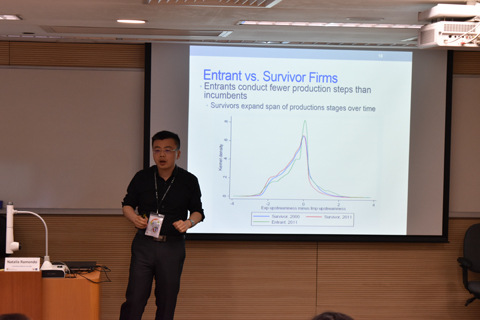

10:5011:15 The Global Production Line Position of Firms in the People’s Republic of China Zhihong YuAssistant Professor, University of Nottingham

Zhihong YuAssistant Professor, University of NottinghamDr. Zhihong Yu is Assistant Professor of Economics in the School, University of Nottingham, and internal fellow of GEP Nottingham and CESIfo in Munich. His main interests are in international trade and foreign direct investment, and economic development with special focus on firm level adjustments to globalization. He has published articles in the Journal of International Economics, Economic Theory, Canadian Journal of Economics and Scandinavian Journal of Economics. Dr. Yu obtained his PhD at the University of Nottingham in 2006.

BioAbstractFull paperPresentationA key trend in international trade over the last two decades has been the rising fragmentation of production across countries. We use firm-level customs data, matched manufacturing census data, and Input-Output tables from the People’s Republic of China (PRC) to better understand where and how PRC firms operate along the global value chain. We characterize each firm's global production line position by computing the “upstreamness” of each firm's export and import mix, using a measure of upstreamness that reflects the number of production stages between the product mix in question and final uses. We document the evolution of PRC firms' global production line position over the 1992-2011 period. We also show how it correlates with firm performance (total exports, sales) and with various underlying firm characteristics (ownership, productivity, capital and skill intensity).

* Co-Authors: Davin Chor and Kalina Manova

11:15 11:25 Discussant Sai DingSenior Lecturer, University of GlasgowBioDiscussion

Sai DingSenior Lecturer, University of GlasgowBioDiscussionDr. Sai Ding is Senior Lecturer in Economics at the University of Glasgow. She joined Economics at Glasgow in 2010, and was postdoctoral research fellow at the University of Oxford, visiting lecturer at Brunel University, and tutor at St. Catherine's College at the University of Oxford. She is a member of the Economic and Social Research Council (ESRC) Peer Review College and a Research Assessor of Carnegie Trust for the Universities of Scotland. Her general research interests are in the areas of economic growth and development, trade and productivity, corporate investment and finance, and the People’s Republic of China economy.

She has published in economic journals such as the Oxford Bulletin of Economics and Statistics, Journal of Comparative Economics, Journal of Banking and Finance, Journal of Productivity Analysis, and Asian Economic Papers. In 2009, she received an ESRC research grant on a project entitled, Understanding Enterprise Investment in [the People’s Republic of] China. In 2012, she co-authored a book, ‘China’s remarkable economic growth’, with Professor John Knight, published by Oxford University Press.

11:25 11:35 Open Discussion

11:35 12:00 Fragmentation and the Product Cycle Edwin LaiProfessor, Hong Kong University of Science and Technology

Edwin LaiProfessor, Hong Kong University of Science and TechnologyEdwin L.-C. Lai is Professor of Economics at the Hong Kong University of Science and Technology. His past full time appointments include: Senior Research Economist and Adviser at the Federal Reserve Bank of Dallas in the United States, Associate Professor at Singapore Management University, Associate Professor at City University of Hong Kong and Assistant Professor at Vanderbilt University. His main research areas are international economics, industrial organization and growth. He has written intensively on the economics of intellectual property rights protection in the global economy, among other topics. He has published in the American Economic Review, RAND Journal of Economics, International Economic Review, Journal of International Economics and other respected economics journals. Prof. Lai has been consultant to the World Bank, visiting scholar/fellow/professor with Boston University, Princeton University, Kobe University, Hitotsubashi University and Hong Kong Institute for Monetary Research. He is an Associate Editor of the Review of International Economics (Wiley Publisher), and a Fellow of the CESifo Research Network. He obtained his BSc in Engineering from The University of Hong Kong, and AM and PhD in Economics from Stanford University.

BioAbstractFull paperPresentationIn this paper, we develop a model of fragmentation in the context of product cycles, with Ricardian comparative advantage driving trade of intermediate goods. Basically we incorporate fragmentation and offshoring of final goods into a model of trade in intermediate goods inspired by Eaton and Kortum (2002). Innovation and offshoring are introduced in the product cycle model following Krugman (1979) and Lai (1998). It is a two-country model with North and South. The North carries out innovation as well as production of all intermediate goods and assembles the final good at the earlier stage of the life cycle of the product, while the South carries out production of some intermediate goods and assembles the final good at the later stage. Fragmentation is defined as the separation of the location of production of intermediate goods and that of the assembly of the final good. We find that as the North becomes better in producing intermediate goods relative to the South, it leads not only to a rise in the North-South wage gap, but also an increase in the extent of global fragmentation. An increase in the rate of technological standardization in the production of final goods, on the other hand, lowers the North-South wage gap and raises the extent of global fragmentation. An increase in the North’s capability to develop new final goods, however, lowers the degree of global fragmentation. An exogenous increase in fragmentation, possibly due to changes in technology of production, would increase the North-South wage gap.

* Co-Author: Han (Steffan) Qi

12:00 12:10 Discussant Davin ChorAssociate Professor, National University of SingaporeBioDiscussion

Davin ChorAssociate Professor, National University of SingaporeBioDiscussionDavin Chor is Associate Professor at the Department of Economics, National University of Singapore. His research interests are in international trade, political economy and economic history. His work in international trade focuses on understanding how institutional and policy forces affect patterns of comparative advantage and multinational activity. He presently serves as Associate Editor at the Journal of International Economics and the Review of International Economics. Davin completed his A.B. in Economics summa cum laude from Harvard University in 2000. He also holds an A.M. in Statistics (2000) and a PhD in Economics (2007) from Harvard.

12:10 12:20 Open Discussion

12:20 13:50 LunchEliot Room, 14/F, K.K. Leung Building, HKU

Session 2:

Drivers of FDI–Domestic Policy, Regulations and Institutions

-

Chair

Hongsong ZhangAssistant Professor, The University of Hong KongBio

Hongsong ZhangAssistant Professor, The University of Hong KongBioHongsong Zhang obtained his PhD in Economics at Pennsylvania State University in 2013. His main research interests cover topics on empirical industrial organization, international trade, and applied microeconomics. His current research focuses on measurement of productivity and demand shock, research and development (R&D), innovation, and their interaction with firm (dynamic) activities such as participation in importing/exporting, R&D investment, new product development, entry/exit decisions, capital investment decisions, and bilateral international trade.

13:50–13:55 Session Opening

13:55–14:20 Policy Factors Influencing FDI Inflows to Developing Countries Hyun-Hoon LeeProfessor, Kangwon National University

Hyun-Hoon LeeProfessor, Kangwon National UniversityHyun-Hoon Lee is Professor of International Economics at Kangwon National University, Republic of Korea, and is former Dean of Asia-Pacific Cooperation Academy at Kangwon National University. He was Senior Analyst at Asia-Pacific Economic Cooperation (APEC)’s Policy Support Unit. He also served as Senior Environmental Affairs Officer at the United Nations Economic and Social Commission for Asia and the Pacific and was Visiting Professor/scholar at University of British Columbia, University of Melbourne, Keio University, and the Bank of Korea. Dr. Lee received his PhD in Economics from the University of Oregon. He has published extensively in books and leading international journals on problems of international trade policy and economic development; and regional economic cooperation in Asia and the Pacific.

BioAbstractFull paperPresentationMany studies have found that foreign direct investment (FDI) can play a positive role in spurring economic growth and income of host countries. FDI can take the form of investment in new assets (greenfield investment) or acquisition of existing assets (mergers and acquisitions; M&A). Because of their distinctive characteristics, the two FDI modes may have different effects. This paper empirically evaluates how institutional and policy factors influence greenfield and M&A investment to developing countries. For this purpose, this paper utilizes bilateral greenfield and M&A investments for the period 2003-2014. We offer a number of new findings. Among the three sets of host country-specific factors, we find that the quality of local governance is the most important factor for both greenfield and M&A investments to developing countries, whereas FDI restrictive policies of developing countries are not significant factors in restricting FDI inflows to these countries. We also find that an improvement in host country’s environment for doing business may have a positive effect on greenfield investment only when the host country’s governance quality is very low. Among the pair-specific policy factors, regional trade agreements have a significantly positive impact on greenfield investment flows to developing countries, while bilateral investment treaties do not exert any positive effect either on greenfield investment or M&A investment.

14:20–14:30 Discussant Maggie ChenAssociate Professor, George Washington UniversityBioDiscussion

Maggie ChenAssociate Professor, George Washington UniversityBioDiscussionMaggie Xiaoyang Chen is Associate Professor of Economics and International Affairs at George Washington University. Professor Chen's areas of research expertise include multinational firms, international trade, and regional trade agreements. Her work has been published extensively in leading academic journals. She worked as an economist in the research department of the World Bank in 2011-2012, and as senior consultant and advisor for various regional divisions of the World Bank and the International Finance Cooperation since 2003. She has been a contributor to the World Development Report and World Bank’s Latin America and Caribbean Flagship Report. Professor Chen currently serves as trade policy advisor at the US Congressional Budget Office, leading policy analyses on the economic effects of the Trans-Pacific Partnership Agreement. She is also co-editor of Economic Inquiry. Professor Chen received her PhD and M.A. in Economics from the University of Colorado Boulder and her B.A. in Economics from Beijing Normal University.

14:30–14:40 Open Discussion

14:40–15:05 Patent Protection and the Industrial Composition of Multinational Activity: Evidence from US Multinationals Olena IvusAssistant Professor, Queen’s University

Olena IvusAssistant Professor, Queen’s UniversityDr. Olena Ivus is Assistant Professor of Business Economics at Smith School of Business. Her research employs both theory and empirical work to study aspects of international trade law and regulation, foreign direct investment, intellectual property protection, and research & development activity. Her work has been published in leading journals, including the Journal of International Economics, Canadian Journal of Economics, Economic Inquiry, and Journal of International Business Studies. Dr. Olena received a Thomas Edison Innovation Fellowship for 2016-2017 from the Center for the Protection of Intellectual Property at George Mason University School of Law. Dr. Olena is also currently Senior Fellow at the Centre for International Governance Innovation. Dr. Olena earned a PhD. in Economics (2009) from the University of Calgary. Prior to joining Queen's University in 2010, Dr. Olena was Assistant Professor at the University of Prince Edward Island, and attended as Visiting Researcher at the Institute of Economic Research, Hitotsubashi University. In 2010, Dr. Olena won the World Trade Organization Essay Award for Young Economists.

BioAbstractFull paperPresentationUsing data on United States firms' technology licensing to local agents in developing countries, this paper examines the impact of patent protection on internal and arms-length technology transfer. The effects of protection vary across products according to their complexity. Simple products are relatively easy to imitate and so firms producing these products choose the more secure means of transfer via affiliates and subsidiaries, and also rely on a host country's patent rights to further limit the risk of technology misappropriation. Consistent with theories of internalization, stronger patent protection enables local firms to attract more arms-length technology transfer. The attractiveness of affiliated licensing rises as well among simple-product firms, strong enough that the composition of their licensing shifts towards affiliated parties. The results withstand several robustness checks, and are equally strong whether patent protection is measured by its intensity or by the timing of reforms. The results have significance for recent work on the internalization theories of multinational firms as well as for patent policy in the developing world, where access to knowledge is critical.

* Co-Authors: Walter Park, and Kamal Saggi

15:05–15:15 Discussant Celine AzemarSenior Lecturer (Associate Professor), University of GlasgowBioDiscussion

Celine AzemarSenior Lecturer (Associate Professor), University of GlasgowBioDiscussionCeline Azemar is Senior Lecturer (Associate Professor) in Economics at the University of Glasgow.

Celine is particularly interested in the impact of international corporate taxation on multinational firms' behaviour. Recent papers have covered the effect of corporate taxes on foreign direct investment; multinational firms’ tax avoidance/evasion strategies; tax competition between countries; the role of tax sparing provisions; the determinants of the tax burden differential between domestic and foreign firms; the incidence of corporate taxes on wages. Among other journals, she has published in the Canadian Journal of Economics, International Tax and Public Finance, The World Economy.

Celine obtained her PhD in Economics at University Paris I (Paris School of Economics).

15:15 15:25 Open Discussion

15:25–15:40 Coffee break

Session 3:

Drivers of FDI International Investment Policy

-

Chair

Susan StoneDirector, United Nations Economic and Social Commission for Asia and the PacificBio

Susan StoneDirector, United Nations Economic and Social Commission for Asia and the PacificBioSusan Stone is Director, Trade, Investment and Innovation Division, ESCAP. Previously, she served as Senior Trade Policy Analyst in the Trade and Agriculture Directorate of the Organisation for Economic Cooperation and Development (OECD). Her main research activities have centered on trade and its interaction with various economic outcomes, most recently, on employment, especially trade along global value chains. She has also studied the relationship between trade and transport, poverty reduction, and environmental outcomes. Her work has been published in national/international government reports as well as peer reviewed journals. Prior to joining OECD, she was a Senior Research Fellow at the Asian Development Bank Institute and prior to that, Research Manager at the Australian Productivity Commission. Ms. Stone has a PhD in Economics from Drexel University in the United States.

15:40 15:45 -

Session Opening

15:45 16:05 -

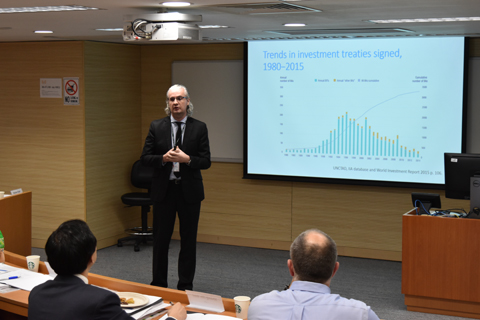

Impact of Investment Treaties on FDI Flows: Making the Linkages between Policy Expectations and Treaty Variances

Julien ChaisseAssociate Professor, The Chinese University of Hong Kong

Julien ChaisseAssociate Professor, The Chinese University of Hong KongProfessor Chaisse is an award-winning specialist in international economic law with particular expertise in the regulation and economics of foreign investment. His research also covers other relevant fields, such as World Trade Organization (WTO) law, international taxation and the law of natural resources. Before joining the CUHK Law Faculty in 2009, Prof. Chaisse served in the Ministry of Foreign Affairs of France, and started his academic career in Europe. Since then, Prof. Chaisse is frequently invited as a guest lecturer to many academies and universities around the world, including the Academy of International Investment and Trade Law, Columbia University, Brown University and Boston University (US), Passau University (Germany) and Melbourne University (Australia) where he is a Senior Fellow to the Law School.

Prof. Chaisse has authored a broad body of well-regarded and widely-cited articles on topics ranging from the rise of sovereign wealth funds, the regulation of foreign investment, and decision-making challenges facing the WTO, which have been published in the top refereed journals of international law. In recognition of his outstanding scholarly achievements, Prof. Chaisse received the CUHK Research Excellence Award in 2012, and was appointed Director of the Center for Financial Regulation and Economic Development of our Faculty since 2013.

Professor Chaisse currently advises the E15 Task Force on Investment Policy, sponsored jointly by the World Economic Forum and the International Center for Trade and Sustainable Development.

BioAbstractFull paperPresentationSince investment-related provisions in bilateral investment treaties (BITs) and free trade agreements (FTAs) are heterogeneous and complex, conducting sound empirical analyses is not easy. In order to overcome this, it is helpful to conduct a “conceptual” work to examine the mechanisms in which investment provisions in BITs/FTAs affect foreign direct investment (FDI), in addition to empirical analyses. All empirical analysis, in order to be compared (over countries, continents or time) should be developed against the canvass of a robust conceptual framework. This conceptual paper provides several hypotheses on the impact of BITs/FTAs on FDI, which can be tested in empirical studies. The following are amongst the important points to discuss in examining the mechanisms in which BITs/FTAs affect FDI: The difference between BIT and investment chapter in FTA in terms of provision coverage; Which provisions in BITs/FTAs are likely to have a significant impact on FDI; The interrelationships among provisions within one BIT/FTA and, altogether, their impact on FDI; The interrelationships among agreements signed by a pair of countries. How does the impact of BITs on FDI vary in combination with FTAs? i.e. when there is a BIT combined to a FTA dealing with trade matters only (e.g. Japan-Malaysia BIT combined to Japan-ASEAN FTA) and/or when there is a BIT coupled to a FTA with investment Chapter (e.g. China-Australia BIT + China-Australia FTA 2015).

The interrelationship among BITs/FTAs signed by one country with various partners, especially through most favored nation (MFN); Under what external conditions (e.g. governance quality of recipient country) are provisions likely to be effective and have an impact on FDI; which provision’s impact on FDI is dependent on external conditions?

16:0516:25 -

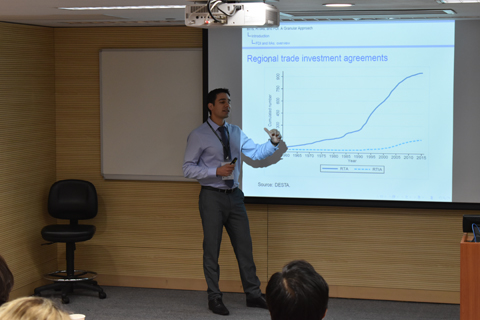

A Granular Approach to the Effects of Bilateral Investment Treaties (BITs) and Regional Trade Investment Agreements (RTIAs) on FDI

Rodolphe DesbordesReader, University of Strathclyde

Rodolphe DesbordesReader, University of StrathclydeRodolphe Desbordes is a Reader in Economics at the University of Strathclyde. He holds a BA in Political Science (Sciences Po Paris) and a PhD in International Economics (University of Paris I Pantheon-Sorbonne). He has widely published in the fields of foreign direct investment, economic growth, and applied econometrics. His most recent papers can be found in the Canadian Journal of Economics, Journal of Comparative Economics, and Scandinavian Journal of Economics. He frequently visits the International Monetary Fund and the World Bank and provides consulting services to various governments and private entities. He is affiliated to LIEPP-Sciences Po Paris and GREQAM (Aix-Marseille University).

BioAbstractFull paperPresentationWe adopt a granular approach to investigate the impact of bilateral investment treaties (BITs) and regional trade investment agreements (RTIAs) on foreign direct investment (FDI). Using detailed and under-exploited databases, our empirical analysis explicitly takes into account the heterogeneity of both treaties and FDI projects. We find that BITs specifically granting access to an investor-state dispute mechanism and RTIAs specifically protecting foreign investors from discrimination have a large, positive, and statistically significant effect on FDI. These results hold when we distinguish FDI flows according to the partners involved, the entry mode, or the destination sector. The focus on specific investment provisions and various robustness checks suggest that our findings are not driven by reverse causality or an omitted variable bias. Overall a `pro-FDI' BIT or RTIA can be expected to increase the number of FDI projects by 35% and 58%, respectively.

16:2516:40 -

Discussant

Junkyu LeePrincipal Economist, Asian Development BankBioDiscussion

Junkyu LeePrincipal Economist, Asian Development BankBioDiscussionA national of the Republic of Korea, Dr. Junkyu Lee joined the Asian Development Bank (ADB) in November 2012. Before joining ADB, he was G20 Special Advisor to the Republic of Korea Finance Ministry since the G20 Seoul Summit. He was also Senior International Economic Advisor since 2009 and one of six Advisory Panel members of the ASEAN+3 Macroeconomic Research Office from May 2011 to November 2012. From 2008–2011, he was Visiting Professor at Seoul National University and Korea University, teaching economic policies to graduate students. He was a trade negotiator for the [Republic of] Korea-US Free Trade Agreement (FTA) and the [Republic of] Korea-European Union FTA. He holds a BA and MA degree in international economics from Seoul National University and earned his PhD in political economy and public policy from the Economics Department of the University of Southern California.

16:4016:50 Open Discussion

16:5017:00 Sessions Break

Plenary Session 1:

Keynote Lecture by Wolfgang Keller

Professor, University of Colorado Boulder-

Chair

Larry QiuProfessor, The University of Hong KongBio

Larry QiuProfessor, The University of Hong KongBioLarry received his bachelor degree in Mathematics from Zhongshan University, and both a master degree and a PhD degree in Economics from University of British Columbia.

Larry joined The Hong Kong University of Science and Technology as an assistant professor in 1993 and later became an associate professor and full professor. He joined The University of Hong Kong (HKU) as a full professor in January 2008. He holds visiting professor/scholar positions in many academic institutions. He has published widely in international economics journals and books. His research interests include international trade and policy, foreign direct investment, mergers and acquisitions, and industrial organization.

Larry serves on the editorial board of many academic journals, including as the associate editor of International Economics. He is the current president of Hong Kong Economic Association. He is also the Associate Dean (Knowledge Exchange) and Director of Executive Education at Faculty of Business and Economics, HKU, as well as an associate director of Institute of China and Global Development, HKU.

17:0017:45 FDI and Spillovers: Is There a Role for Public Subsidies? Wolfgang KellerProfessor, University of Colorado BoulderBioLecture

Wolfgang KellerProfessor, University of Colorado BoulderBioLectureWolfgang Keller is professor at the University of Colorado Boulder. He is research associate of the Center for Economic Studies (CES)-Ifo Institute for Economic Research (CESifo Group), the National Bureau of Economic Research (NBER), as well as the Centre for Economic Policy Research (CEPR). Professor Keller works on the interface between international trade and the economics of technology, as well as on issues of growth and long-run development, most recently in the People’s Republic of China.

Earlier, Professor Keller was on the faculty at the University of Wisconsin at Madison and the University of Texas at Austin, as well as visiting professor at Princeton, Stanford, and Brown universities. He received his diploma from Freiburg University in 1990 and his PhD from Yale University in 1995. Professor Keller’s articles have been published in the American Economic Review, the Journal of Political Economy, the Journal of Econometrics, among others.

17:4518:00 Open Discussion

18:00 Dinner hosted by The University of Hong Kong

Friday, 3 June 2016

Session 4:

Impacts of FDI on Entrepreneurship, Exports, and Domestic Investment

-

Chair

Larry QiuProfessor, The University of Hong KongBio

Larry QiuProfessor, The University of Hong KongBioLarry received his bachelor degree in Mathematics from Zhongshan University, and both a master degree and a PhD degree in Economics from University of British Columbia.

Larry joined The Hong Kong University of Science and Technology as an assistant professor in 1993 and later became an associate professor and full professor. He joined The University of Hong Kong (HKU) as a full professor in January 2008. He holds visiting professor/scholar positions in many academic institutions. He has published widely in international economics journals and books. His research interests include international trade and policy, foreign direct investment, mergers and acquisitions, and industrial organization.

Larry serves on the editorial board of many academic journals, including as the associate editor of International Economics. He is the current president of Hong Kong Economic Association. He is also the Associate Dean (Knowledge Exchange) and Director of Executive Education at Faculty of Business and Economics, HKU, as well as an associate director of Institute of China and Global Development, HKU.

09:00 09:05 Session Opening

09:0509:30 FDI and Entrepreneurship: Gender Differences across the World Rajeev GoelProfessor, Illinois State University

Rajeev GoelProfessor, Illinois State UniversityRajeev K. Goel is Professor in Economics at Illinois State University. He received his PhD in Economics from the University of Houston. He is the author of two scholarly books and more than 100 academic journal articles, which can be accessed at http://econpapers.repec.org/RAS/pgo308.htm.

BioAbstractFull paperPresentationUsing recent cross-national data, this paper examines the impact of foreign direct investment (FDI) on entrepreneurship. The impact of FDI on entrepreneurship is not clear a priori with the possibilities of both a negative effect (crowding out) and a positive effect (synergy or complementarity). Results find support for the crowding out effect; however, this effect varies across nations with different prevalence of entrepreneurship. Another focus is on gender differences. The crowding out effect is stronger for the full sample, rather than the subsample of female entrepreneurship and this finding stands up to a battery of robustness checks. Policy implications of the findings are discussed.

09:3009:40 Discussant Michael RobertsHead of Aid-for-Trade Unit, World Trade OrganizationBioDiscussion

Michael RobertsHead of Aid-for-Trade Unit, World Trade OrganizationBioDiscussionMichael Roberts has been Head of the Aid-for-Trade Unit in the Development Division of the WTO since January 2009. The Aid for Trade Initiative seeks to assist developing countries connect to the multilateral trading system. Michael is leading preparations for the 6th Global Review of Aid for Trade: "Promoting Connectivity" to be held in mid-2017. He joined WTO in 2001, starting his career in the Agriculture and Commodities Division. Between 2003 and 2009, he established and led the Standards and Trade Development Facility. Prior to joining WTO, he worked in the Russian Federation and the United Kingdom (UK) on agriculture and trade policy issues between 1994 and 2001. Michael is an agricultural and development economist by training and holds degrees from University of Oxford and the University of Kent at Canterbury in the UK.

09:4009:50 Open Discussion

09:5010:15 Aid for Trade, Foreign Direct Investment and Export Upgrading in Recipient Countries Michael RobertsHead of Aid-for-Trade Unit, World Trade Organization

Michael RobertsHead of Aid-for-Trade Unit, World Trade OrganizationMichael Roberts has been Head of the Aid-for-Trade Unit in the Development Division of the WTO since January 2009. The Aid for Trade Initiative seeks to assist developing countries connect to the multilateral trading system. Michael is leading preparations for the 6th Global Review of Aid for Trade: "Promoting Connectivity" to be held in mid-2017. He joined WTO in 2001, starting his career in the Agriculture and Commodities Division. Between 2003 and 2009, he established and led the Standards and Trade Development Facility. Prior to joining WTO, he worked in the Russian Federation and the United Kingdom (UK) on agriculture and trade policy issues between 1994 and 2001. Michael is an agricultural and development economist by training and holds degrees from University of Oxford and the University of Kent at Canterbury in the UK.

BioAbstractFull paperPresentationThis paper examines empirically whether Aid for Trade (AfT) programmes and Foreign Direct Investment (FDI) inflows affect export upgrading and, if so, whether their effects are complementary or substitutable. Export upgrading entails export diversification (including overall export diversification, as well as diversification at the intensive and at the extensive margins) and export quality improvement. The empirical analysis shows that total AfT flows have a strong positive impact on export upgrading, and that least developed countries (LDCs) as compared to Non-LDCs, are the most important beneficiaries of this positive impact. While the impact of FDI inflows on export diversification in host economies is mixed, these flows do exert a strong positive impact on export quality upgrading. Furthermore, the impact of FDI on export diversification is higher in LDCs than in Non-LDCs. Incidentally, AfT and FDI inflows appear substitutes (in an economic theory sense) in achieving export diversification and complementary in their effect on the improvement of export quality in recipient countries, including LDCs. Results obtained on the impact of components of total AfT are inconclusive, as they suggest both complementarity and substitutability with respect to FDI inflows in affecting export upgrading in recipient countries.

Overall, empirical results suggest that AfT and FDI inflows are effective in influencing export upgrading in recipient countries. However, the results also highlight the importance of the interplay between these two kinds of capital flows in affecting export development strategies and FDI policies of recipient countries, notably LDCs.

We can infer from this study that AfT flows appear to play a particularly important role in ensuring that FDI inflows do not lead to further export concentration, by putting in place the necessary conditions for export diversification.

* Co-Author: Sèna Kimm Gnangnon

10:1510:25 Discussant Hyun-Hoon LeeProfessor, Kangwon National UniversityBioDiscussion

Hyun-Hoon LeeProfessor, Kangwon National UniversityBioDiscussionHyun-Hoon Lee is Professor of International Economics at Kangwon National University, Republic of Korea, and is former Dean of Asia-Pacific Cooperation Academy at Kangwon National University. He was Senior Analyst at Asia-Pacific Economic Cooperation (APEC)’s Policy Support Unit. He also served as Senior Environmental Affairs Officer at the United Nations Economic and Social Commission for Asia and the Pacific and was Visiting Professor/scholar at University of British Columbia, University of Melbourne, Keio University, and the Bank of Korea. Dr. Lee received his PhD in Economics from the University of Oregon. He has published extensively in books and leading international journals on problems of international trade policy and economic development; and regional economic cooperation in Asia and the Pacific.

10:2510:35 Open Discussion

10:3510:50 Coffee Break

10:5011:15 Have International Investment Agreements had an Impact on Science, Technology, and Innovation in the Asia-Pacific Region? Susan StoneDirector, United Nations Economic and Social Commission for Asia and the Pacific

Susan StoneDirector, United Nations Economic and Social Commission for Asia and the PacificSusan Stone is Director, Trade, Investment and Innovation Division, ESCAP. Previously, she served as Senior Trade Policy Analyst in the Trade and Agriculture Directorate of the Organisation for Economic Cooperation and Development (OECD). Her main research activities have centered on trade and its interaction with various economic outcomes, most recently, on employment, especially trade along global value chains. She has also studied the relationship between trade and transport, poverty reduction, and environmental outcomes. Her work has been published in national/international government reports as well as peer reviewed journals. Prior to joining OECD, she was a Senior Research Fellow at the Asian Development Bank Institute and prior to that, Research Manager at the Australian Productivity Commission. Ms. Stone has a PhD in Economics from Drexel University in the United States.

BioAbstractFull paperPresentationThe Asia Pacific region is a major player in FDI, with developing Asia’s FDI outflows alone accounting for 1.1 times the dollar value of North American outflows and 1.4 times that of Europe in 2014. East Asia alone accounted for 43% of all developing-economy FDI. Increasingly International investment Agreements (IIAs) are being put in place to manage and control these investment flows. According to UNCTAD, by the end of 2014, there were more than 3,200 IIAs in place, where almost half, or 1,500, have been signed by one or more parties from the region. With the focus shifting towards crafting IIAs to attract the ‘right’ types of foreign direct investment (FDI), there has been more attention on high-technology industries and knowledge economies, and fostering STI competence and capabilities through FDI. In this regard, Science, technology and innovation (STI) related provisions are increasingly included in IIAs and other relevant trade/investment agreements.

This paper examines the current landscape of IIAs in regard to STI in the Asia-Pacific region. As there are no empirical studies identified which deal with STI-related provisions in IIAs of the region, the paper initially examines the degree to which STI-related provisions are included in IIAs and other relevant trade/investment agreements which includes one or more parties from the region. The paper reports the outcomes of an analysis of a sample of signed agreements which include an adequate representation of the population of agreements signed in the region. This analysis consists of a categorization of the types of STI-related provisions based on common themes such as technological and technical cooperation, information technology, clean technology, and Intellectual Property Rights (IPR). It also examines if there are any significant differences by the types of agreements, level of development of signed parties, year of signature, and/or other characteristics. Also, it will attempt to identify if there are any enforcing mechanisms that would prompt countries to implement/revise relevant policies. It strives to examine if these STI provisions in IIAs have any relationship with STI competence and capabilities in host countries.

11:1511:25 Discussant Celine AzemarSenior Lecturer (Associate Professor), University of GlasgowBioDiscussion

Celine AzemarSenior Lecturer (Associate Professor), University of GlasgowBioDiscussionCeline Azemar is Senior Lecturer (Associate Professor) in Economics at the University of Glasgow.

Celine is particularly interested in the impact of international corporate taxation on multinational firms' behaviour. Recent papers have covered the effect of corporate taxes on foreign direct investment; multinational firms’ tax avoidance/evasion strategies; tax competition between countries; the role of tax sparing provisions; the determinants of the tax burden differential between domestic and foreign firms; the incidence of corporate taxes on wages. Among other journals, she has published in the Canadian Journal of Economics, International Tax and Public Finance, The World Economy.

Celine obtained her PhD in Economics at University Paris I (Paris School of Economics).

11:2511:35 Open Discussion

11:3512:00 The Impact of FDI in Vertically Integrated Sectors on Domestic Investment: Firm Level Evidence from the Republic of Korea Asli LeblebiciogluAssistant Professor, University of Texas at Dallas

Asli LeblebiciogluAssistant Professor, University of Texas at DallasAsli Leblebicioglu is Assistant Professor of Economics at the University of Texas at Dallas. Her fields of specialization are international macroeconomics, growth and development. She has published her work in leading economics journals, such as the Journal of International Economics and Journal of Development Economics.

BioAbstractFull paperPresentationTo analyze the effects of FDI on domestic firms' investment, we use a detailed firm level data-set from the Republic of Korea for 2006–2014. We combine it with the input-output tables provided by the Bank of Korea to construct industry level measures of multinational presence in sectors that are horizontally and vertically linked, and estimate dynamic investment equations that are augmented with these foreign presence measures. We find a positive and significant effect of foreign presence in both horizontally and vertically linked industries on domestic firms' investment rate, with larger effects arising from multinational presence in the supplying sectors. Quantitatively, a 2 percentage point increase in the presence of multinational suppliers increases a domestic firm’s investment rate by 2.29 percentage points. We also find that this effect is larger for small and medium firms, private firms, non-exporters and for firms in external finance dependent industries. A similar 2 percentage point increase in the foreign presence in downstream sectors increases the investment rate of domestic suppliers by 0.71 percentage points. This effect is larger if the domestic firm is part of a chaebol, or is in a less external finance dependent industry. The effect of a 2 percentage point increase in horizontal FDI is also positive, but smaller at 0.42percentage points.

* Co-Author: Kwang Soo Kim

12:0012:10 Discussant Han (Steffan) QiAssistant Professor, Hong Kong Baptist UniversityBioDiscussion

Han (Steffan) QiAssistant Professor, Hong Kong Baptist UniversityBioDiscussionHan (Steffan) QI obtained his PhD in Economics in Hong Kong University of Science and Technology in 2014 and joined the Department of Economics, School of Business of Hong Kong Baptist University as an assistant professor in the same year. His main research interests cover topics in international trade, international finance and Chinese economy. His current research focuses on international fragmentation of production, research and development (R&D), gravity equation of trade and regional integration.

12:1012:20 Open Discussion

12:2013:50 LunchEliot Room, 14/F, K.K. Leung Building, HKU

Session 5:

FDI and Technological Spillovers

-

Chair

Davin ChorAssociate Professor, National University of SingaporeBio

Davin ChorAssociate Professor, National University of SingaporeBioDavin Chor is Associate Professor at the Department of Economics, National University of Singapore. His research interests are in international trade, political economy and economic history. His work in international trade focuses on understanding how institutional and policy forces affect patterns of comparative advantage and multinational activity. He presently serves as Associate Editor at the Journal of International Economics and the Review of International Economics. Davin completed his A.B. in Economics summa cum laude from Harvard University in 2000. He also holds an A.M. in Statistics (2000) and a PhD in Economics (2007) from Harvard.

13:50 13:55 -

Session Opening

13:5514:20 -

Selection and Market Reallocation: Productivity Gains from Multinational Production

Maggie ChenAssociate Professor, George Washington University

Maggie ChenAssociate Professor, George Washington UniversityMaggie Xiaoyang Chen is Associate Professor of Economics and International Affairs at George Washington University. Professor Chen's areas of research expertise include multinational firms, international trade, and regional trade agreements. Her work has been published extensively in leading academic journals. She worked as an economist in the research department of the World Bank in 2011-2012, and as senior consultant and advisor for various regional divisions of the World Bank and the International Finance Cooperation since 2003. She has been a contributor to the World Development Report and World Bank’s Latin America and Caribbean Flagship Report. Professor Chen currently serves as trade policy advisor at the US Congressional Budget Office, leading policy analyses on the economic effects of the Trans-Pacific Partnership Agreement. She is also co-editor of Economic Inquiry. Professor Chen received her PhD and M.A. in Economics from the University of Colorado Boulder and her B.A. in Economics from Beijing Normal University.

BioAbstractFull paperPresentationAssessing the productivity gains from multinational production has been a vital topic of economic research and policy debate. Positive aggregate productivity gains are often attributed to within-.rm productivity improvement; however, an alternative, less emphasized explanation is between-.rm selection and market reallocation, whereby competition from multinationals leads to factor reallocation and the survival of only the most productive domestic .rms. We investigate the roles of the two different mechanisms in determining the aggregate productivity gains by exploring their distinct predictions on the distributions of domestic firms: within-firm productivity improvement shifts the productivity and revenue distributions rightward, while between-.rm selection and market reallocation raise the left truncation of the distributions and shift revenue leftward. Using a rich cross-country firm-level panel dataset, we find significant evidence of both mechanisms, but between-firm selection and market reallocation account for the majority of aggregate productivity gains, suggesting that ignoring this channel could lead to substantial bias in understanding the nature of gains from multinational production.

* Co-Author: Laura Alfaro

14:2014:30 -

Discussant

Hongsong ZhangAssistant Professor, The University of Hong KongBioDiscussion

Hongsong ZhangAssistant Professor, The University of Hong KongBioDiscussionHongsong Zhang obtained his PhD in Economics at Pennsylvania State University in 2013. His main research interests cover topics on empirical industrial organization, international trade, and applied microeconomics. His current research focuses on measurement of productivity and demand shock, research and development (R&D), innovation, and their interaction with firm (dynamic) activities such as participation in importing/exporting, R&D investment, new product development, entry/exit decisions, capital investment decisions, and bilateral international trade.

14:3014:40 Open Discussion

14:4015:05 The Effect of Foreign Entry Regulation on Downstream Productivity: Microeconomic Evidence from the Peoples Republic of China (PRC) Sai DingSenior Lecturer, University of Glasgow

Sai DingSenior Lecturer, University of GlasgowDr. Sai Ding is Senior Lecturer in Economics at the University of Glasgow. She joined Economics at Glasgow in 2010, and was postdoctoral research fellow at the University of Oxford, visiting lecturer at Brunel University, and tutor at St. Catherine's College at the University of Oxford. She is a member of the Economic and Social Research Council (ESRC) Peer Review College and a Research Assessor of Carnegie Trust for the Universities of Scotland. Her general research interests are in the areas of economic growth and development, trade and productivity, corporate investment and finance, and the People’s Republic of China economy.

She has published in economic journals such as the Oxford Bulletin of Economics and Statistics, Journal of Comparative Economics, Journal of Banking and Finance, Journal of Productivity Analysis, and Asian Economic Papers. In 2009, she received an ESRC research grant on a project entitled, Understanding Enterprise Investment in [the People’s Republic of] China. In 2012, she co-authored a book, ‘China’s remarkable economic growth’, with Professor John Knight, published by Oxford University Press.

BioAbstractFull paperPresentationUsing a unique measure of foreign entry regulation, we examine the largely ignored indirect impacts of foreign entry barriers on downstream manufacturing activities in the People’s Republic of China. We find that there exists a significant liberalizing move in the manufacturing sector, whereas restrictions in the service sector remain stringent. Our results show that foreign entry barriers in the upstream manufacturing and service industries curb downstream firm productivity. The effect depends on some industry-specific features such as their distance to the world technological frontier, technology sharing similarity and labor structure similarity between upstream and downstream industries. Some firm-specific features such as R&D investment and service and material outsourcing are vital channels through which upstream regulations impact downstream productivity.

* Co-Authors: Puyang Sun and Wei Jiang

15:0515:15 Discussant Zhihong YuAssistant Professor, University of NottinghamBioDiscussion

Zhihong YuAssistant Professor, University of NottinghamBioDiscussionDr. Zhihong Yu is Assistant Professor of Economics in the School, University of Nottingham, and internal fellow of GEP Nottingham and CESIfo in Munich. His main interests are in international trade and foreign direct investment, and economic development with special focus on firm level adjustments to globalization. He has published articles in the Journal of International Economics, Economic Theory, Canadian Journal of Economics and Scandinavian Journal of Economics. Dr. Yu obtained his PhD at the University of Nottingham in 2006.

15:1515:25 Open Discussion

15:2515:40 Coffee Break

Session 6:

Outward FDI from Emerging Economies

-

Chair

Hyun-Hoon LeeProfessor, Kangwon National UniversityBio

Hyun-Hoon LeeProfessor, Kangwon National UniversityBioHyun-Hoon Lee is Professor of International Economics at Kangwon National University, Republic of Korea, and is former Dean of Asia-Pacific Cooperation Academy at Kangwon National University. He was Senior Analyst at Asia-Pacific Economic Cooperation (APEC)’s Policy Support Unit. He also served as Senior Environmental Affairs Officer at the United Nations Economic and Social Commission for Asia and the Pacific and was Visiting Professor/scholar at University of British Columbia, University of Melbourne, Keio University, and the Bank of Korea. Dr. Lee received his PhD in Economics from the University of Oregon. He has published extensively in books and leading international journals on problems of international trade policy and economic development; and regional economic cooperation in Asia and the Pacific.

15:40 15:45 Session Opening

15:45 16:05 Financing Constraints and Firm Internalization Ka ZengProfessor, University of Arkansas

Ka ZengProfessor, University of ArkansasKa Zeng is Professor of Political Science and Director of Asian Studies at the University of Arkansas. Her research focuses on the People’s Republic of China’s (PRC’s) role in the global economy, in particular PRC trade policy, PRC-World Trade Organization (WTO) issues, and PRC-related trade dispute dynamics. Dr. Zeng is the author of Trade Threats, Trade Wars (University of Michigan Press, 2004), co-author of Greening China (University of Michigan Press, 2011), editor of China’s Foreign Trade Policy (Routledge, 2007), and co-editor of China and Global Trade Governance (Routledge, 2013). She is a contributor to journals such as the International Studies Quarterly, Review of International Political Economy, World Development, Journal of World Trade, International Interactions, China Quarterly, Journal of Contemporary China, Social Science Quarterly, and International Relations of the Asia-Pacific. Dr. Zeng is currently Senior Research Fellow and Corporate Secretary at the Wong Center for the Study of Multinational Corporations.

BioAbstractFull paperPresentationTrade and investment increasingly constitute the main forms of firm internationalization. This paper develops a model for analyzing the effect of financing heterogeneity on firm export and investment. We introduce financing heterogeneity into a classic firm-level model, in which firms face a trade-off in their operational mode depending on external financing capacity: whether to serve foreign markets, and whether to do so through exports or local subsidiary sales. Our empirical analysis yields two major findings. First, only those firms with the strongest external financing capacity engage in foreign activities. Second, of those firms that serve foreign markets, only those with the strongest external financing capacity engage in foreign direct investment (FDI). These results have important policy implications for a country such as the People’s Republic of China (PRC) that is highly dependent on exports for economic growth and yet suffers from weak financial institutions. They suggest that by reducing financing constraints and financial market frictions, efforts to build a more efficient, market-oriented, and flexible financial system could facilitate the internationalization of the most competitive and efficient PRC firms, while at the same time enhancing PRC international competitiveness and promoting the transformation of its mode of trade growth.

* Co-Author: Yue Lü

16:0516:25 Outward FDI and Domestic Input Distortions: Evidence from PRC Firms Cheng ChenAssistant Professor, The University of Hong Kong

Cheng ChenAssistant Professor, The University of Hong KongDr. Cheng Chen joined The University of Hong Kong in August 2014. His research areas are applied microeconomic theory, international economics and organizational economics. His research interests include the study of firm organization and management (e.g., outsourcing versus foreign direct investment [FDI], family firms, firm hierarchies) in an open economy, patterns of multinational firms and FDI originating from developing economies, and the impact of uncertainty on international trade and FDI. Dr. Chen has published a paper in the Journal of International Economics and served as referees for the Quarterly Journal of Economics, the Journal of International Economics and the International Economics Review. Dr. Chen obtained his PhD from Princeton University in 2014, his master degree from Hitotsubashi University in 2008, and his bachelor degree from Nanjing University in 2005.

BioAbstractFull paperPresentationThis paper examines how domestic distortions affect firms’ investment strategies abroad. The study first documents puzzling empirical findings concerning multinational corporations in the People’s Republic of China, which include private multinational corporations, are less productive than state-owned multinational corporations. A theoretical model is built to rationalize these findings and yields additional empirically consistent predictions. The key insight is that discrimination against private firms domestically incentivizes these firms to produce abroad, which results in less tough selection into foreign direct investment for them. A calibration exercise shows the quantitative impacts of domestic distortions on gains in aggregate productivity after investment liberalization.

* Co-Authors: Wei Tian and Miaojie Yu

16:2516:40 Discussant Fahad KhanEconomist, Asian Development BankBioDiscussion

Fahad KhanEconomist, Asian Development BankBioDiscussionFahad Khan is an Economist in the Economic Research and Regional Cooperation Department of Asian Development Bank. He joined the Asian Development Bank after completing his PhD from Australian National University in 2015, and holds a BA from Yale University. He is also an honorary visiting research fellow at the Australian National University. His primary research fields are empirical political economy, economic development and international economics. He has published in Economic Letters and PLOS Medicine.

16:4016:50 Open Discussion

16:5017:00 Sessions Break

Plenary Session 2:

Keynote Lecture by Stephen Yeaple

Professor, The Pennsylvania State University-

Chair

Shang-Jin WeiChief Economist, Asian Development BankBio

Shang-Jin WeiChief Economist, Asian Development BankBioMr. Wei is Chief Economist of the Asian Development Bank and Director General of its Economic Research and Regional Cooperation Department (ERCD). Mr. Wei is chief ADB spokesperson on economic and development trends, and leads ERCD, which publishes ADB flagship knowledge products. ERCD also coordinates ADB support for various regional cooperation fora such as ASEAN+3 and APEC.

Mr. Wei earned his PhD in Economics and Master's degree in Finance from the University of California, Berkeley; a Master's degree in Economics from Pennsylvania State University; and a Bachelor's degree in World Economy from Fudan University in the People's Republic of China.

17:0017:45 -

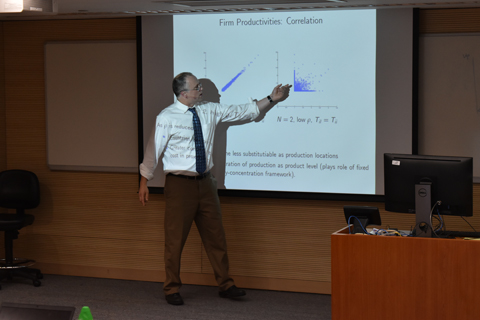

On the Challenges of Estimating the Gains from Multinational Production

Stephen YeapleProfessor, The Pennsylvania State UniversityBioLecture

Stephen YeapleProfessor, The Pennsylvania State UniversityBioLectureStephen Yeaple is Professor of Economics at Pennsylvania State University. His research focuses on the sources and implications of firm heterogeneity, the international organization of multinational firms, and the general equilibrium implications of offshoring. His research has been supported by grants from the US National Science Foundation amongst others. His work has been published in a number of journals, including the American Economic Review, International Economic Review, Journal of International Economics, Review of Economic Studies, Review of Economics and Statistics, and Strategic Management Journal. He is research associate with the National Bureau of Economic Research (NBER), a research affiliate of CESifo, and is co-editor at the Journal of International Economics. Stephen has also held positions at the Federal Reserve Bank of New York, the University of Pennsylvania, Princeton University, and the University of Colorado Boulder. He is a graduate of Swarthmore College and received his PhD in Economics from the University of Wisconsin at Madison.

17:4518:00 -

Open Discussion

Closing Session:

Closing Remarks

18:0018:05 -

Closing Remarks

Shang-Jin WeiChief Economist, Asian Development Bank

Shang-Jin WeiChief Economist, Asian Development Bank 18:05 -

Dinner hosted by The University of Hong Kong

Event photos