-

- Themes

- Database

- AEIR Data Catalogue

- Free Trade Agreements

- Macroeconomic database:

- Regional Cooperation and Integration database:

- Daily Market Watch

- Resources

- Events

- Economies

- Central Asia

- East Asia

- Oceania

- South Asia

- Southeast Asia

- The Pacific

- COVID-19

Asian Economic Integration Report 2017

The Asian Economic Integration Report 2017 is ADB’s annual report on Asia’s progress in regional cooperation and integration (RCI). It covers ADB’s 48 regional members and analyzes regional as well as global economic linkages. This year’s special theme chapter, “The Era of Financial Interconnectedness: How Can Asia Strengthen Financial Resilience?” reexamines the region’s ability to absorb financial shocks and avoid instability. The report also introduces an RCI composite index to help monitor and evaluate RCI progress in the region. The Asia-Pacific Regional Cooperation and Integration Index combines six RCI components: trade and investment, money and finance, regional value chains, infrastructure connectivity, movement of people, and institutional and social integration.

The newly-introduced Asia-Pacific Regional Cooperation and Integration Index (ARCII) allows Asian economies to track and monitor the progress of their regional integration efforts across six different socioeconomic dimensions.

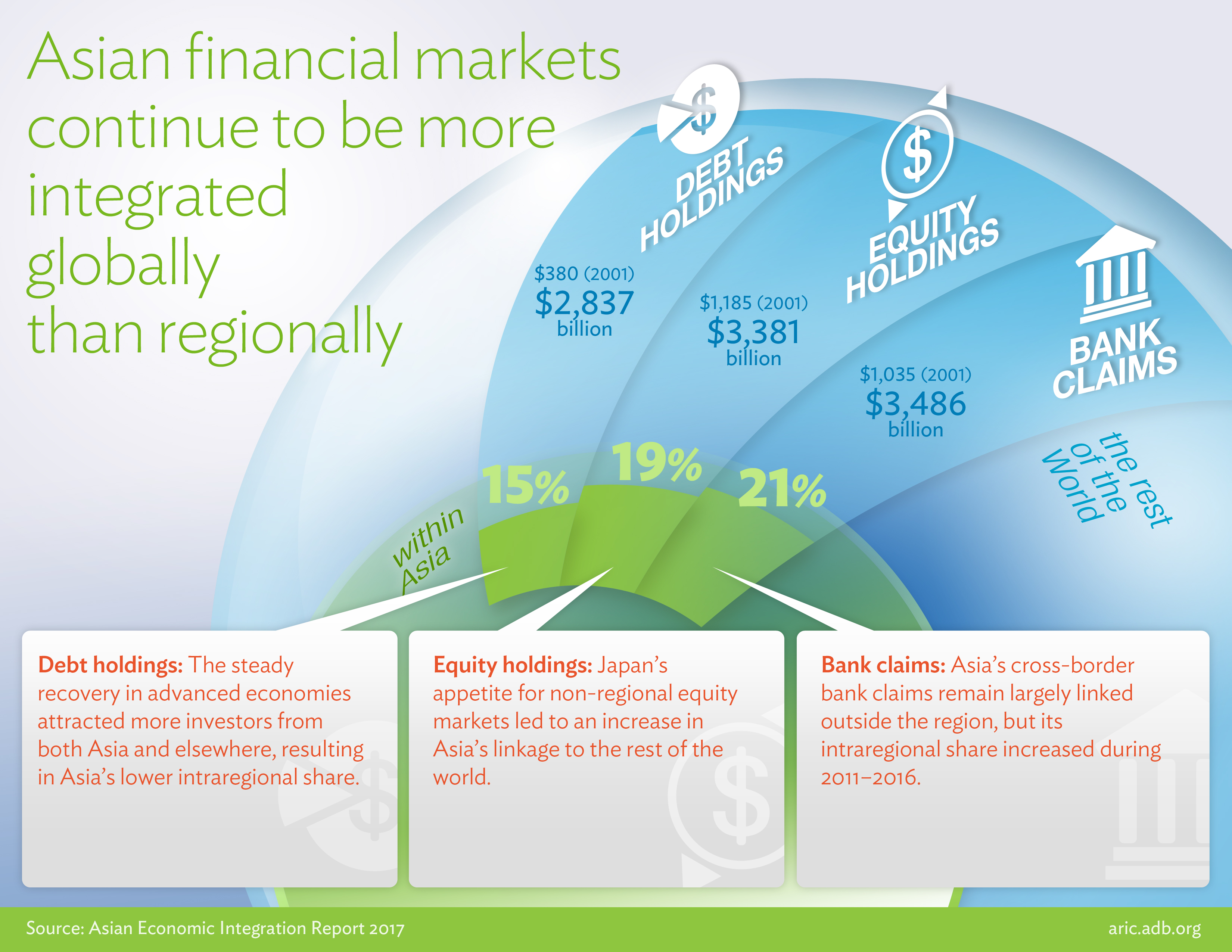

Asia remains more financially linked to the rest of the world than to itself.

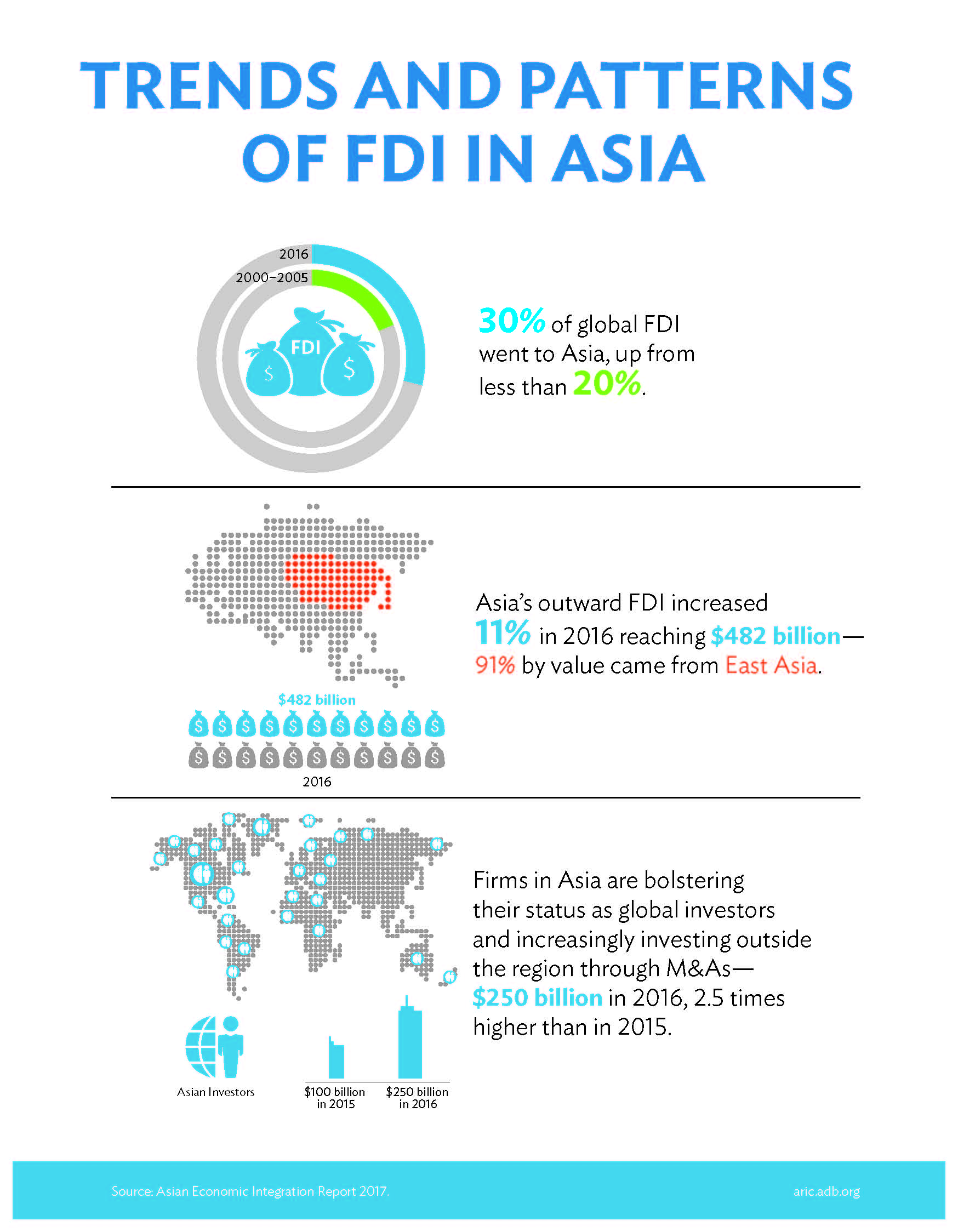

Amid a slowdown in total inward foreign direct investment to Asia, intraregional investment flows continue to rise.

Firms in Asia are bolstering their status as global investors.

A large part of intraregional FDI is greenfield investment, mainly in manufacturing, while M&As; are more dominant for FDI going outside the region.

Asia’s intraregional trade continued to strengthen, providing a buffer against potential headwinds from global trade and policy uncertainties.

Tourism is growing rapidly in the region, both in terms of the number of tourists and the amount of tourism receipts.

Remittances to Asia declined in 2016, but its impact within the region was varied.

Twenty years after the Asian financial crisis, Asia stands strong—with more flexible exchange rates, higher foreign reserves, healthier financial systems, stronger regulations, deeper capital markets, and better regional financial cooperation mechanisms.

Growing financial interconnectedness can increase vulnerabilities to external shocks, financial contagion, or liquidity risks stemming from cross-border bank lending.

Contents:

Download chapter

Cover and highlights

Download chapterRegional Outlook, Linkages, and Vulnerabilities

- Regional Outlook, Integration, and Challenges

- Transmission Mechanism

- Emerging Vulnerabilities

- Coping Mechanisms

- Concluding Remarks

Download chapterTrade and the Global Value Chain

- Recent Trends in Asias Trade

- Asias Intraregional Trade

- Progress of Global and Regional Value Chains

- Updates on Regional Trade Policy

Download chapter Download Online AnnexCross-border Investment

- Trends and Patterns of FDI in Asia

- Outward FDI

Download chapterFinancial Integration

- Progress in Cross-border Financial Transactions

- Analysis using Price Indicators

- Financial Spillovers

Download chapterRemittances and Tourism Receipts

- Remittance Flows to Asia

- Tourism Receipts

Download chapterSubregional Initiatives

- Central and West Asia: Central Asia Regional Economic Cooperation Program

- Southeast Asia: Greater Mekong Subregion Program

- East Asia: Support to CAREC and GMS Programs

- South Asia: South Asia Subregional Economic Cooperation

- The Pacific: Regional Approach to Renewable Energy Investments

- Toward Regional Connectivity

Download chapterAsia-Pacific Regional Cooperation and Integration Index

- Introduction to Asia-Pacific Regional Cooperation and Integration Index (ARCII)

- Construction of the ARCII

- Empirical results

- Policy implications

Download chapter Download Online AnnexTheme Chapter: The Era of Financial Interconnectedness: How Can Asia Strengthen Financial Resilience?

- Introduction

- Experiences and Lessons from Past Crises

- Financial Conditions, Vulnerabilities, and Cycles in Asia

- New Global Financial Conditions and Vulnerability

- Asias Financial Interconnectedness, Transmission, and

- Spillovers of Shocks and Risks

- Conclusions and Policy Considerations

- Background Papers

Download chapterStatistical Appendix

Launch details:

On 25 October 2017, a team of ADB researchers, led by Chief Economist Yasuyuki Sawada, presented the key findings of the AEIR 2017 at Lee Kuan Yew School of Public Policy in Singapore and to international and regional media. See news release.

Download Programme 'Asian Economic Integration Report 2017 Roundtable Discussion'Event Photos:

In the news:

25Oct2017Business Mirror25Oct2017Asian Development BankInfographics:

8Feb2018How can Asia strengthen financial resilience?

Continued support for financial reforms is crucial to ensuring Asia's financial resilience.

31Jan2018New index measures progress of RCI in Asia

The newly-introduced ARCII aims to measure the extent and progress of regional cooperation and integration in Asia and the Pacific.

29Jan2018Greater intraregional tourism continues to visit Asia

Tourism is looking up in Asia, with increased number of travelers and tourism receipts

26Jan2018Trends in Asia’s Regional Trade

Asia's trade volume growth surpassed that of world in 2016

24Jan2018Financial Integration in Asia

Asia's cross-border assets continue to grow, further strengthening its linkages globally.

22Jan2018Foreign Direct Investment in Asia

Asia's is increasingly a magnet of foreign direct investment and a prominent global investor

18Jan2018Free Trade Agreements in Asia

ARIC's infographic illustrates the latest trends and insights on Asia's FTA landscape.

AEIR Archives:

ASIA REGIONAL INTEGRATION CENTER© 2015 Asian Development Bank. All rights reserved. Reproduction in whole or in part without permission is prohibited.About usThe Asia Regional Integration Center (ARIC) is an ongoing technical assistance project of the Economic Research and Development Impact Department (ERDI). Following the 1997/98 Asian financial crisis and the contagion evident around the region, ADB was asked to use its knowledge-based expertise to help monitor the recovery and report objectively on potential vulnerabilities and policy solutions. With the ASEAN+3 process just starting, ADB provided technical assistance beginning in 1999—to create the Asia Recovery Information Center, the precursor to ARIC.Contact usPlease help us improve the ARIC website by sending us your comments. These may be on content, (e.g., articles posted on or for which links are provided in the ARIC website), website structure (e.g., do you find ARIC's sections useful?), ease of navigation, or even page design and layout.

Send all your comments to: aric_info[at]adb.orgQuick links

Other ADB sites:

ADB Regional Cooperation and Integration | Asian Bonds Online | Asian Development Bank Institute | RTA Exchange